Trading Analysis

Blockchain Trader

Watch the video below to see a sample of what we offer members of our Blockchain subscription

Trading analysis Blockchain Trader

“A timely and insightful research and alert service that will benefit traders of all skill levels. I scan the market constantly to demonstrate what I believe are the best trading opportunities in crypto.”

Subscribe to Trading Analysis Blockchain so you can prosper in the atmosphere of crypto volatility with analysis and actionable trade alerts.

We utilize the theory and real-world application of the methodology that can quite literally crack the code of the market.

There is no better trading and investing methodology in the world to help you gain context of the current market status and help you position for safety and then prosperity.

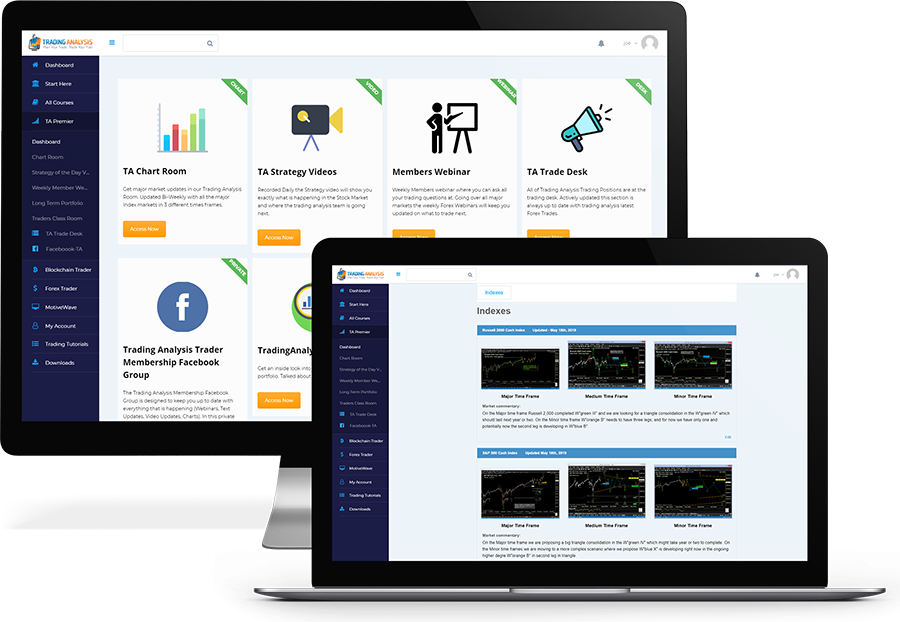

TradingAnalysis Premier Membership Services:

SMS Updates

Our SMS Alerts are designed to give you actionable trades with clear entry, stops, targets and position sizing. Every alert sends out is highly reviewed by Todd and the team at trading analysis. To look at our current record look at this sheet. JEFF KENNEDY REPORT?

Daily Members Updates

Each day Todd produces a new video update with HD recording software. Showing you what trades are setting up, giving key market updates plus insight and showing you how to manage risk.

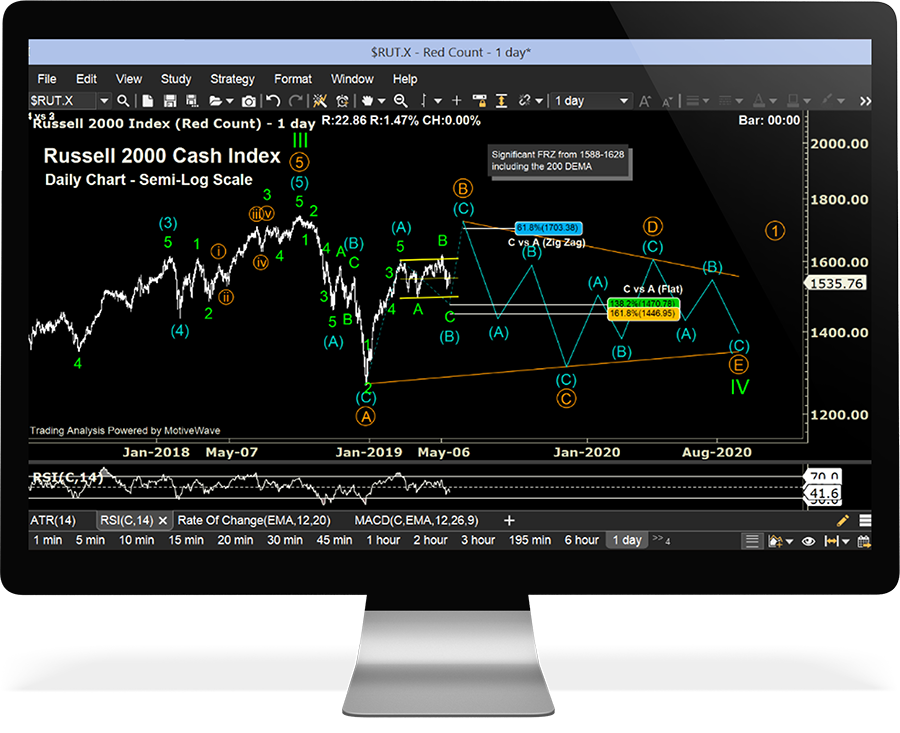

Chart Room

Update Bi-Weekly. The Chartroom are a series of Long, Medium to short outlook on current index prices, gold prices, and the 30-year bond. They are charts you can reference back to daily.

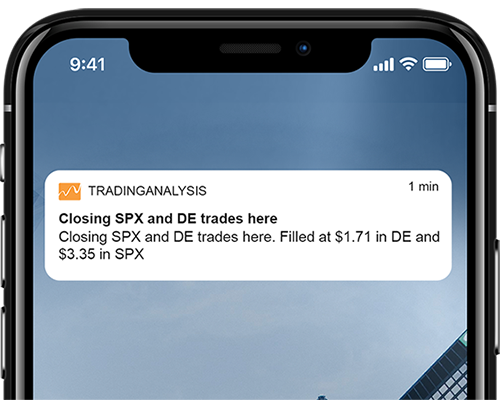

Push Notification

Our new App has allowed us to increase the speed at which you receive updates. just like our SMS update these push notification give customers actionable market updates.

Alerts List

With $100,000 starting capital todd has been pacing the market. Updates throughout the week on positions put on and taken off. The Long Term Portfolio is updated weekly with current holding in MSFT, COST, and V take an inside look at what an Elliott Wave fund Manager trades.

Members Webinar

Each week Todd holds a webinar to answer all Q&A related questions you have. Come here each week to ask anything trade-related. From Reviewing current positions, placing new trades, analyzing current charts the weekly members-only webinar is your go-to place for any question.

TradingAnalysis Premier Membership Services:

SMS Updates

Daily Members Updates

Chart Room

SMS Push Notification

Alerts List

Members Webinar

Trading Analysis Blockchain Trader

- Daily video updates with analysis on all of our positions

- Chart Room with Elliott Wave Analysis

- Live Trade Alerts in our Trading Analysis App

- Weekly Member’s Only Webinar

- Tutorials, On-boarding Videos, and much more!

27

For 14 Days, Then $177/Monthly

Risk Disclaimer

DISCLAIMER: Futures, stocks and options trading involves substantial risk of loss and is not suitable for every investor. The valuation of futures, stocks and options may fluctuate, and, as a result, clients may lose more than their original investment. The impact of seasonal and geopolitical events is already factored into market prices. The highly leveraged nature of futures trading means that small market movements will have a great impact on your trading account and this can work against you, leading to large losses or can work for you, leading to large gains.

If the market moves against you, you may sustain a total loss greater than the amount you deposited into your account. You are responsible for all the risks and financial resources you use and for the chosen trading system. You should not engage in trading unless you fully understand the nature of the transactions you are entering into and the extent of your exposure to loss. If you do not fully understand these risks you must seek independent advice from your financial advisor.

All trading strategies are used at your own risk.

Any content on tradinganalysis.com should not be relied upon as advice or construed as providing recommendations of any kind. It is your responsibility to confirm and decide which trades to make. Trade only with risk capital; that is, trade with money that, if lost, will not adversely impact your lifestyle and your ability to meet your financial obligations. Past results are no indication of future performance. In no event should the content of this correspondence be construed as an express or implied promise or guarantee.

Tradinganalysis.com is not responsible for any losses incurred as a result of using any of our trading strategies. Loss-limiting strategies such as stop loss orders may not be effective because market conditions or technological issues may make it impossible to execute such orders. Likewise, strategies using combinations of options and/or futures positions such as “spread” or “straddle” trades may be just as risky as simple long and short positions. Information provided in this correspondence is intended solely for informational purposes and is obtained from sources believed to be reliable. Information is in no way guaranteed. No guarantee of any kind is implied or possible where projections of future conditions are attempted.

Disclaimer

None of the content published on tradinganalysis.com constitutes a recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. None of the information providers or their affiliates will advise you personally concerning the nature, potential, value or suitability of any particular security, portfolio of securities, transaction, investment strategy or other matter.

CFTC RULE 4.41 – HYPOTHETICAL OR SIMULATED PERFORMANCE RESULTS HAVE CERTAIN LIMITATIONS. UNLIKE AN ACTUAL PERFORMANCE RECORD, SIMULATED RESULTS DO NOT REPRESENT ACTUAL TRADING. ALSO, SINCE THE TRADES HAVE NOT BEEN EXECUTED, THE RESULTS MAY HAVE UNDER-OR-OVER COMPENSATED FOR THE IMPACT, IF ANY, OF CERTAIN MARKET FACTORS, SUCH AS LACK OF LIQUIDITY. SIMULATED TRADING PROGRAMS IN GENERAL ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT OF HINDSIGHT. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFIT OR LOSSES SIMILAR TO THOSE SHOWN.