As financials fail, one banking stock could be about to break out

By Todd Gordon

March, 2019

Financials are in a funk.

The sector has tumbled 9 percent over the past year, by far the worst-performing S&P 500 sector over that stretch.

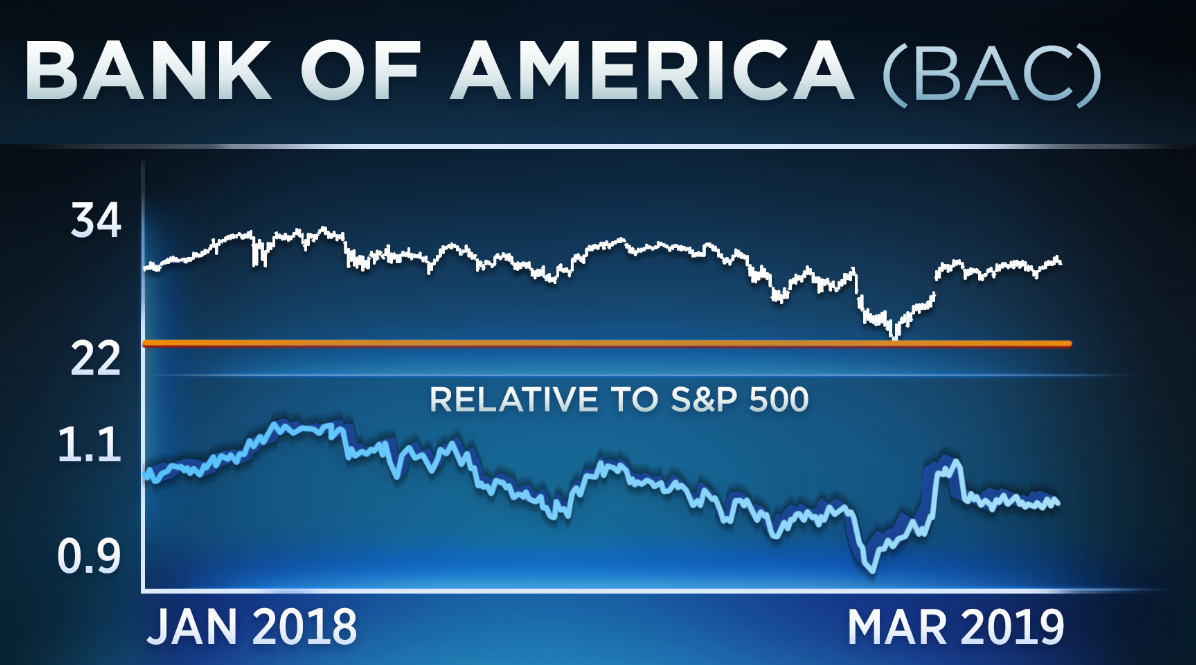

“One financial that I do like is Bank of America, ” Gordon said Wednesday on CNBC’s “Trading Nation. ” “Obviously you have a very nice uptrend here, you’ve broken resistance, we’ve come back to test support.”

“There is a nice kind of level right here at about the $30 region,” Gordon said. “There’s a lot of open interest here. If we can sometimes get a push – and help from the broader market would certainly help – there’s sure to be a lot of stop-loss buying going off in Bank of America. I will add to my holding in Bank despite the financials weakness in the S&P so this is one strong name that I do like.”

Bank of America needs to rally around 5 percent to push through $30. The stock has not traded above that level since October.

The sector is a long-term buy even if it continues to underperform in the short term, said Michael Bapis, managing director of Vios Advisors at Rockefeller Capital Management.

“Banks are stronger than ever from a balance sheet standpoint, from a risk standpoint, they’re taking less risk than they ever have, and from a cash standpoint. Then you throw in earnings, positive earnings and low PEs for many of the banks,” Bapis said Wednesday on “Trading Nation.”

The XLF financial ETF trades at below 12 times forward earnings, while the S&P 500 trades at a 16.5 times multiple.

“This is just a forgotten sector that people have put aside and it is going to snap back at some point in the future,” said Bapis. “I’m positive on the space long term. I’m very surprised that it has taken this long but if we’re taking a long-term perspective for our clients, I’m fine waiting 18 months for it to bounce back.”

The XLF ETF has risen 10 percent this year, below the S&P 500′s 13 percent advance.

Disclosure: Todd Gordon owns shares of Bank of America.

Trading Analysis Todd Gordon

Head Trading Analyst and Founder

Todd has been trading for the last 20+ Years. His goal is to not only provide insightful analysis and trade alerts, but as the quote from the infamous trading classic states, we show you how to think and grow as a professional trader. Todd uses Elliott Wave analysis to trading his edge. Todd has not only traded his money professionally he has also worked at two different hedge funds doing analysis and research. Click Here To Learn More Todd Gordon