Tesla Looks Like Bitcoin And There’s One Way To Benefit

By Todd Gordon

February 7, 2020

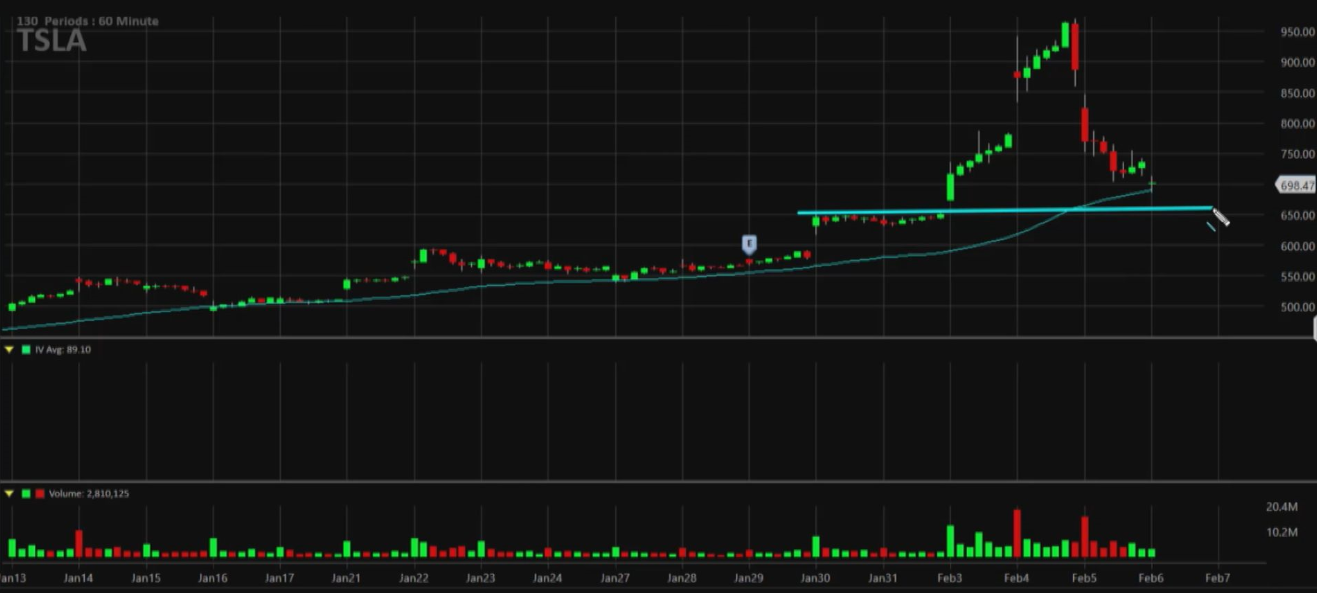

Tesla has been on a wild ride this week.

A massive surge on Monday and Tuesday sent shares up nearly 50% over those two days, but a decline on Wednesday and pause on Thursday reduced those gains to 14% on the week.

Todd Gordon says the surprise surge could continue — and he uses an unconventional comparison to make the case.

“We’re going to look at the hot story stock here — Tesla. An unbelievable run that rivals that parabolic move that we saw even in bitcoin last year and the year before that,” Gordon said Thursday on CNBC’s “Trading Nation.”

Bitcoin went from less than $3,000 in mid-2017 to a peak above $20,000 by the end of that year. Tesla’s charts have shown similar steep moves — shares are up 315% from a June low.

“We’ve seen a pretty strong — very strong — historic move up and a pretty subsequent, impressive pullback here. So, from about [$969] we’ve pulled back to $700 here,” said Gordon.

Tesla hit that record high on Tuesday and has since pulled back 24% to $735. Gordon now sees a potential bottom of $650 to $675 that could “act as a floor as Tesla is trying to gather itself to potentially make another run back up.”

He then sees a gap up that could take Tesla back to the $850 region. That would mark 14% upside.

“The only way I would be trading this stock is with defined risk strategies, specially within the options market. It’s the only way. I’m not going to put real money behind this to buy a $700 stock that could foreseeably drop by half if we’re wrong on this trade, you never know. Options are certainly the way to go here,” said Gordon.

To take advantage of a potential near-term move to the upside in Tesla, Gordon is paying $3 to buy the Feb. 14 800 call options and selling the 820 call option against it. This is a bullish bet that Tesla will rally above $800, or up about 9% from current levels by the end of next week. Tesla was down more than 2% to $731.23 in Friday’s premarket.

Todd Gordon

Founder and Lead Analyst of Trading Analysis

Todd has been trading as a career for the last 20+ years. His goal is to not only provide insightful analysis, but to teach people how to think and grow as professional traders. Todd is a practitioner of Elliott Wave Theory and he uses it to gain an edge in the highly competitive trading arena. In addition to trading professionally, Todd has worked as an analyst and researcher at two different hedge funds. Click Here To Learn More about Todd Gordon