Trading Analysis Premier

Watch This Video and Learn More About Our Trading Analysis Subscription Services

Start your trial today !

Trading analysis Premier

with Bennett Tindle

Bennett is a former network engineer from California who fell in love with the markets early in life. He has been trading options and managing long term portfolios utilizing Elliott Wave and Fibonacci market analysis for the last 5 years. He has a passion for all things technical, and thoroughly enjoys all aspects of the financial markets. When he isn’t hard at work behind the desk, he can be found traversing the skies of texas in a single-engine Cessna.

Subscribe to Trading Analysis Premier to prosper in the coming age of stock market volatility with actionable trade analysis and alerts.

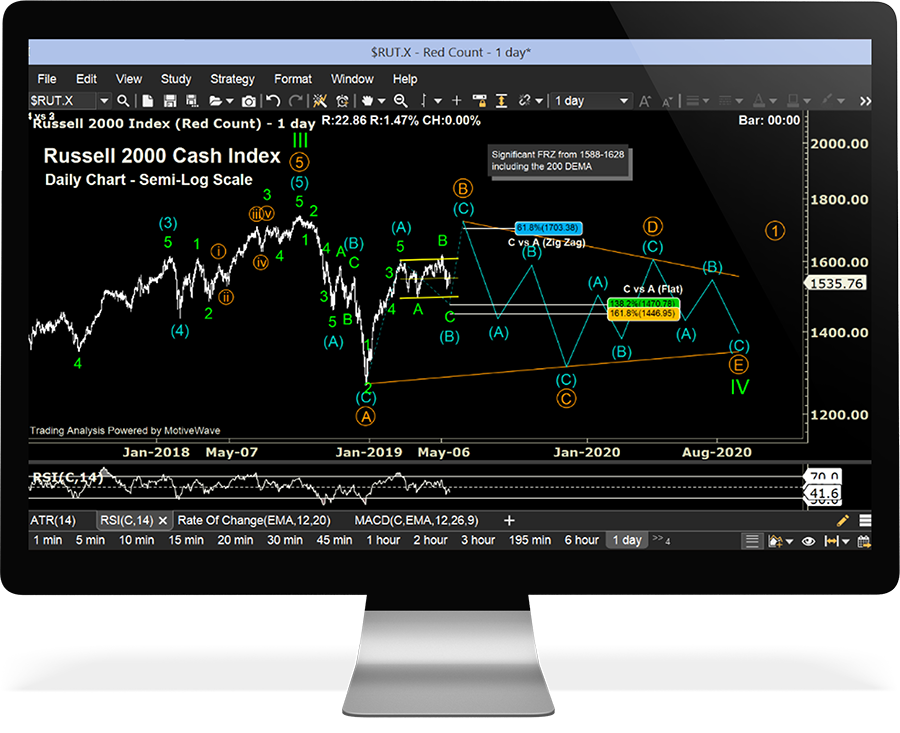

At Trading Analysis we use the same methodology preferred by the largest traders, investment banks, and hedge funds. Elliott Wave Analysis is one of the best-known methodologies of capital market analysis, but also the least understood by the retail trading community. Join Bennet Tindle of TradingAnalysis and his community of real traders who plan their trades, and trade their plans.

Bennett utilizes the real-world application of ElliottWave methodology, which can quite literally crack the code of the market.

A timely and insightful research and alert service that will benefit traders of all skill levels. I scan the markets constantly looking for the best trading opportunities in the equities markets. I trade the opportunities live, in front of you. You get to see all my new moves as soon as they happen. And I tell you exactly why I’m doing what I’m doing.

There is no better trading and investing methodology in the world to help you gain context of the current market status and help you position for safety and then prosperity.

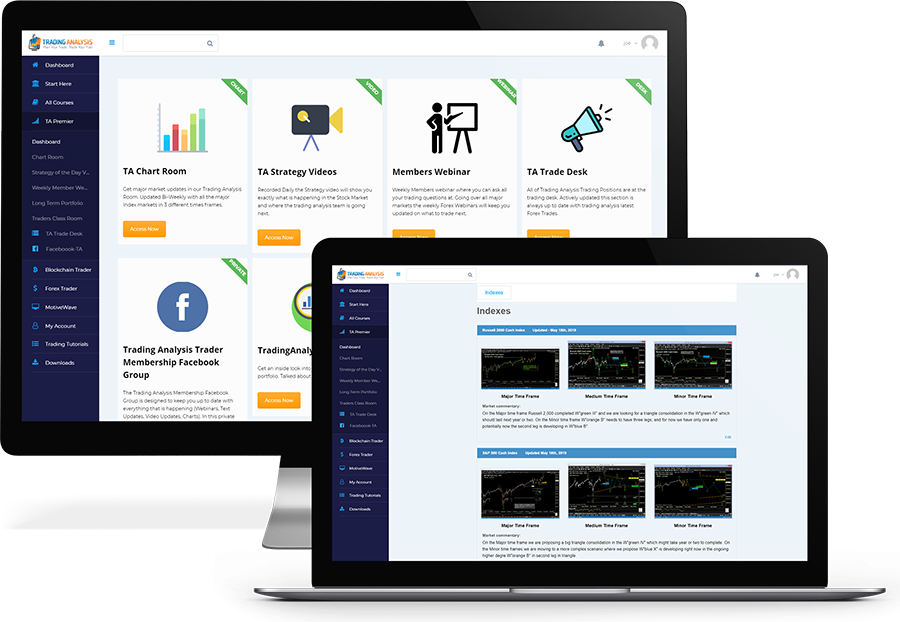

TradingAnalysis Premier Membership Services:

SMS Updates

Our SMS Alerts are designed to give you actionable trades with clear entry, stops, targets and position sizing. Every alert sends out is highly reviewed by Todd and the team at trading analysis. To look at our current record look at this sheet. JEFF KENNEDY REPORT?

Daily Members Updates

Each day Todd produces a new video update with HD recording software. Showing you what trades are setting up, giving key market updates plus insight and showing you how to manage risk.

Chart Room

Update Bi-Weekly. The Chartroom are a series of Long, Medium to short outlook on current index prices, gold prices, and the 30-year bond. They are charts you can reference back to daily.

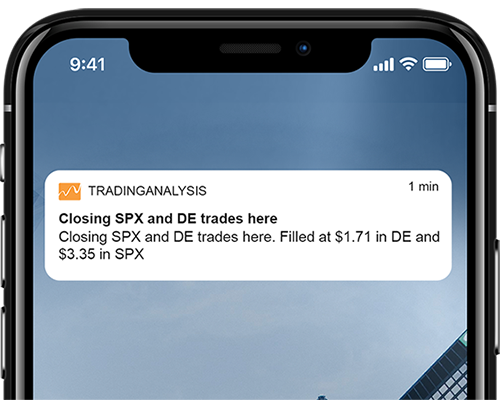

SMS Push Notification

Our new App has allowed us to increase the speed at which you receive updates. just like our SMS update these push notification give customers actionable market updates.

Members Webinar

Each week Todd holds a webinar to answer all Q&A related questions you have. Come here each week to ask anything trade-related. From Reviewing current positions, placing new trades, analyzing current charts the weekly members-only webinar is your go-to place for any question.

TradingAnalysis Premier Membership Services:

SMS Updates

Our SMS Alerts are designed to give you actionable trades with clear entry, stops, targets and position sizing. Every alert sends out is highly reviewed by Todd and the team at trading analysis. To look at our current record look at this sheet. JEFF KENNEDY REPORT?

Daily Members Updates

Each day Todd produces a new video update with HD recording software. Showing you what trades are setting up, giving key market updates plus insight and showing you how to manage risk.

Chart Room

Update Bi-Weekly. The Chartroom are a series of Long, Medium to short outlook on current index prices, gold prices, and the 30-year bond. They are charts you can reference back to daily.

SMS Push Notification

Our new App has allowed us to increase the speed at which you receive updates. just like our SMS update these push notification give customers actionable market updates.

Long Term Portfolio

With $100,000 starting capital todd has been pacing the market. Updates throughout the week on positions put on and taken off. The Long Term Portfolio is updated weekly with current holding in MSFT, COST, and V take an inside look at what an Elliott Wave fund Manager trades.

Members Webinar

Each week Todd holds a webinar to answer all Q&A related questions you have. Come here each week to ask anything trade-related. From Reviewing current positions, placing new trades, analyzing current charts the weekly members-only webinar is your go-to place for any question.

Trading analysis Premier Trader

- Live Trade Stocks, Futures, Commoditeis

- Chart Room With Multiple Time Frame Elliott Wave Analysis

- SMS Trade Alerts

- Trade Desk

- Daily Video

- Tutorials, Onboarding Vids, Weekly Webinar

$47

For 14 Days, Then $177/Monthly

Risk Disclaimer

Futures,Options, and Binary Options Trading all have Large potential awards but also have huge risk. This website is neither a solicitation nor an offer to Buy/Sell futures, options, or Binaries. No representation is being made that any account will or is likely to achieve profits or losses similar to those discussed on this web site. The past performance of any trading system or methodology is not necessarily indicative of future results.

HYPOTHETICAL PERFORMANCE DISCLAIMER

Hypothetical performance results have many inherent limitations, some of which are described below. no representation is being made that any account will or is likely to achieve profits or losses similar to those shown; in fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. one of the limitations of hypothetical performance results is that they are generally prepared with the benefit of hindsight. in addition, hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk of actual trading. for example, the ability to withstand losses or to adhere to a particular trading program in spite of trading losses are material points which can also adversely affect actual trading results. there are numerous other factors related to the markets in general or to the implementation of any specific trading program which cannot be fully accounted for in the preparation of hypothetical performance results and all which can adversely affect trading results

CFTC RULE 4.41

Hypothetical or simulated performance results have certain limitations. Unlike an actual performance record, simulated results do not represent actual trading. Also, since the trades have not been executed, the results may have under-or-over compensated for the impact, if any, of certain market factors, such as lack of liquidity. Simulated trading programs in general are also subject to the fact that they are designed with the benefit of hindsight. No representation is being made that any account will or is likely to achieve profit or losses similar to those shown.