Amazon And Two Other Nasdaq 100 Stocks To Watch Ahead Of Index Rebalancing

By Todd Gordon

December 16, 2020

The Nasdaq 100 is about to look a little different.

In its annual rebalancing scheduled for the end of the week, the index will trade Monday with new components Match, American Electric Power and Peloton among others and removes stocks such as Ulta, Citrix and Take-Two.

Ahead of the shake-up, Mark Tepper, president of Strategic Wealth Partners, is adding to his position in two of the largest Nasdaq 100 stocks – Amazon and Netflix.

“Both of these stocks have been duds since the summertime, they traded sideways, they’ve been consolidating since like June. And in my opinion that gives us a good buying opportunity,” Tepper told CNBC’s “Trading Nation” on Tuesday.

Amazon, he said, is a buy when its investment spending is on the rise.

“Amazon tends to go through these heavy investment cycles. … Whenever that happens investors get spooked and the multiple comes down, and then 12 to 18 months later, the investment stops, the profit spigot turns on and everyone gets blown away by the number,” he said. “You buy it when they’re investing heavily and when the stock is treading water.”

Tepper calls it “reasonable” for Amazon to hit $4,000 by the end of 2021. It closed Tuesday just above $3,165.

Like Amazon, Tepper sees opportunity in Netflix, a stock that has pulled back in the last three months. He argues a strong content slate in 2021 should help propel the stock higher.

“They’ve got the secret sauce in the streaming game. They’ve got the perfect blend of quantity and quality. I think Netflix has more pricing power than Disney. I think it goes a lot higher from here,” said Tepper.

Todd Gordon, founder of TradingAnalysis.com, is backing Match as it prepares to enter the Nasdaq 100 at the end of the week. He said Match has done for online dating what Zoom did for videoconferencing in the work-from-home, stay-at-home environment.

While Gordon said the fundamentals remain strong, he sees a band of resistance ahead after the stock rallied 35% in three months.

“Resistance does come in at about $165. [Its relative strength] has not quite reached the old highs of an 88 reading so a little bit more room to go. I hold the stock. I’ll be cautious at this level around $165,” he said during the same “Trading Nation” segment.

Match closed Tuesday at $150.84 a share.

Amazon, Netflix and Match were all higher Wednesday.

Disclosure: Strategic Wealth Partners holds AMZN and NFLX. Todd Gordon holds MTCH.

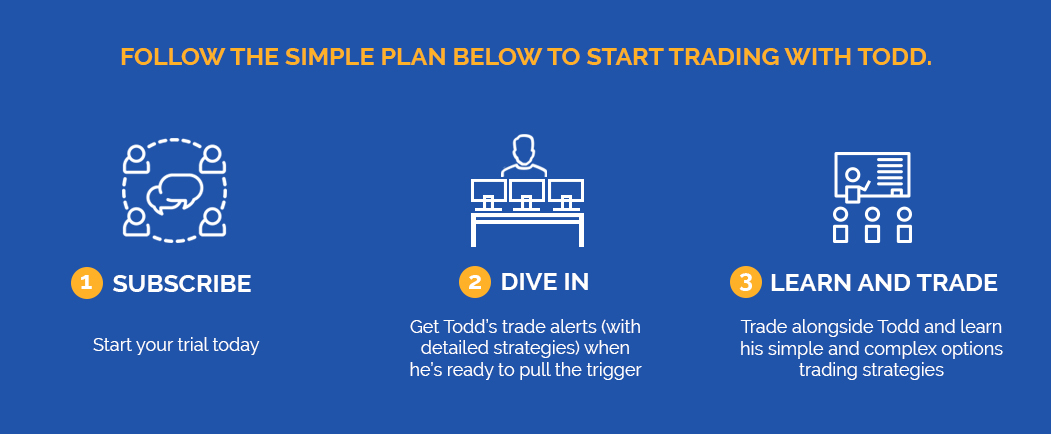

Todd Gordon

Founder and Lead Analyst of Trading Analysis

Todd has been trading as a career for the last 20+ years. His goal is to not only provide insightful analysis, but to teach people how to think and grow as professional traders. Todd is a practitioner of Elliott Wave Theory and he uses it to gain an edge in the highly competitive trading arena. In addition to trading professionally, Todd has worked as an analyst and researcher at two different hedge funds. Click Here To Learn More about Todd Gordon