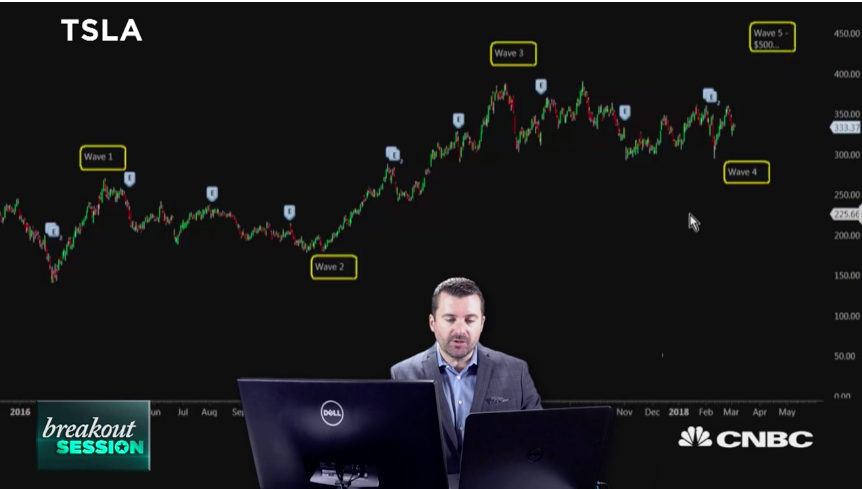

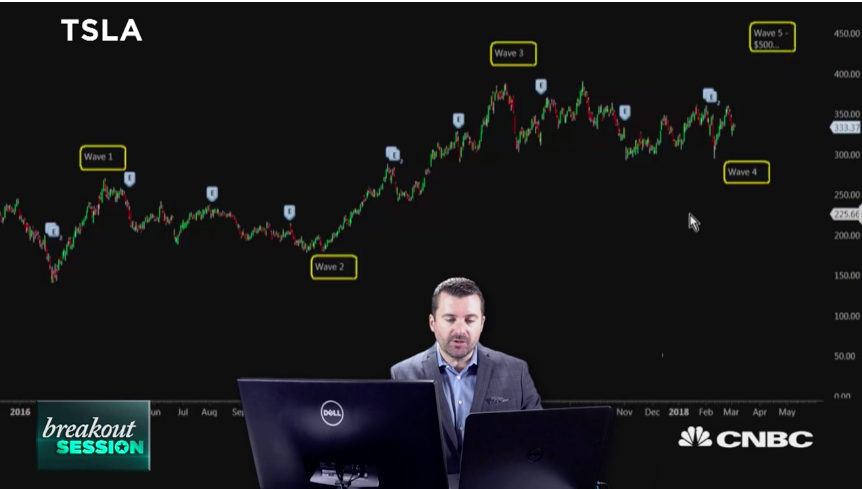

by Todd Gordon | Mar 6, 2018 | Educational Videos

Todd Gordon of TradingAnalysis.com says Tesla’s about to see a big bounce. Trader sees big rally ahead for Tesla from CNBC.

by Todd Gordon | Feb 21, 2018 | Educational Videos

Mark Tepper of Strategic Wealth Partners and Todd Gordon of TradingAnalysis.com discuss Dow components bouncing back recently with Eric Chemi. Four Dow stocks making a major comeback from CNBC.

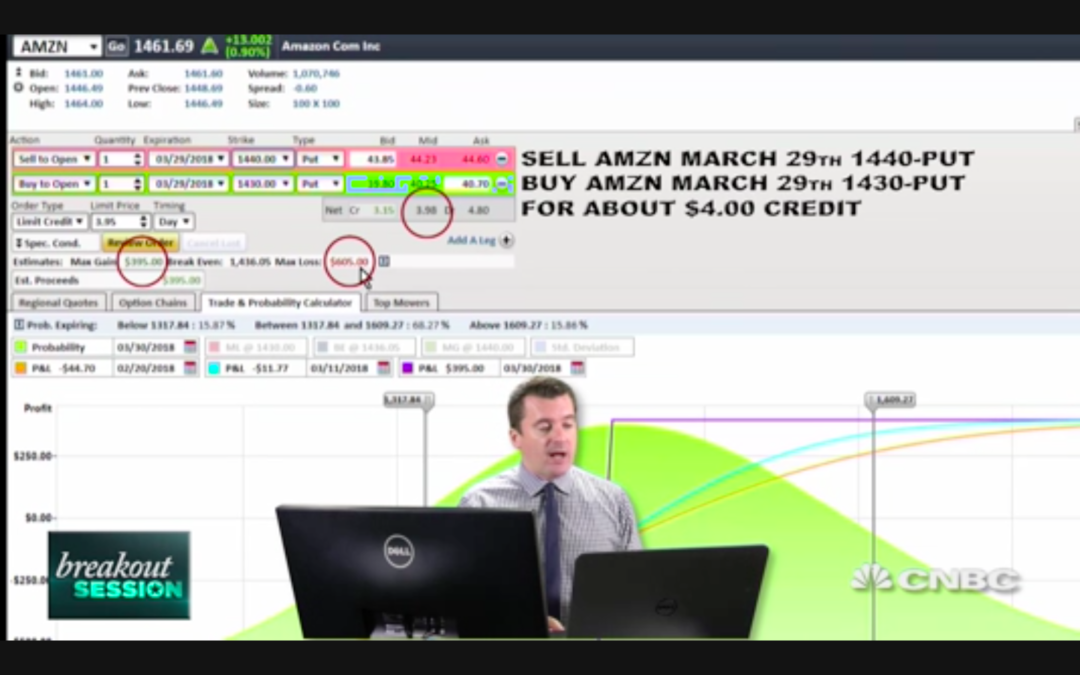

by Todd Gordon | Feb 21, 2018 | Educational Videos

Mark Tepper, Strategic Wealth Partners, and Todd Gordon, TradingAnalysis.com, discuss whether they would buy Amazon or Netflix with Melissa Lee. Trading Nation: Would you rather Amazon or Netflix? from...

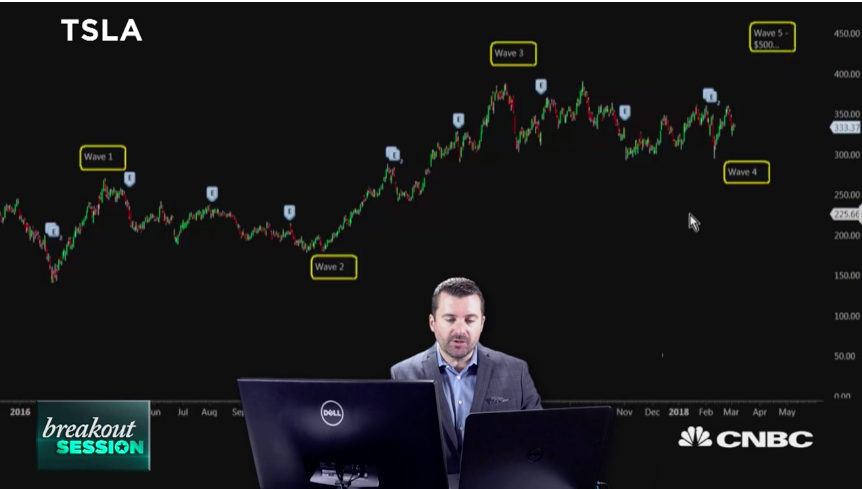

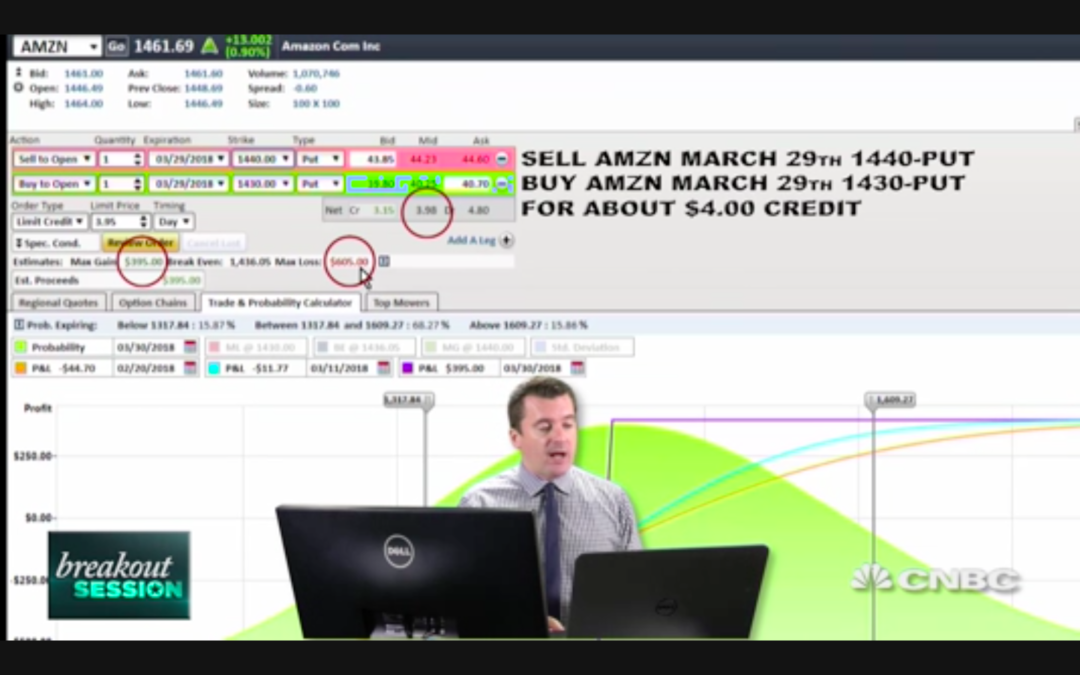

by Todd Gordon | Feb 20, 2018 | Educational Videos

Todd Gordon of TradingAnalysis.com puts on a bullish trade on Amazon. Here’s how one trader is betting on Amazon from CNBC.

by Todd Gordon | Feb 15, 2018 | Educational Videos

TradingAnalysis.com founder Todd Gordon lays out why he’s shorting Facebook. Why one trader is shorting Facebook from CNBC.

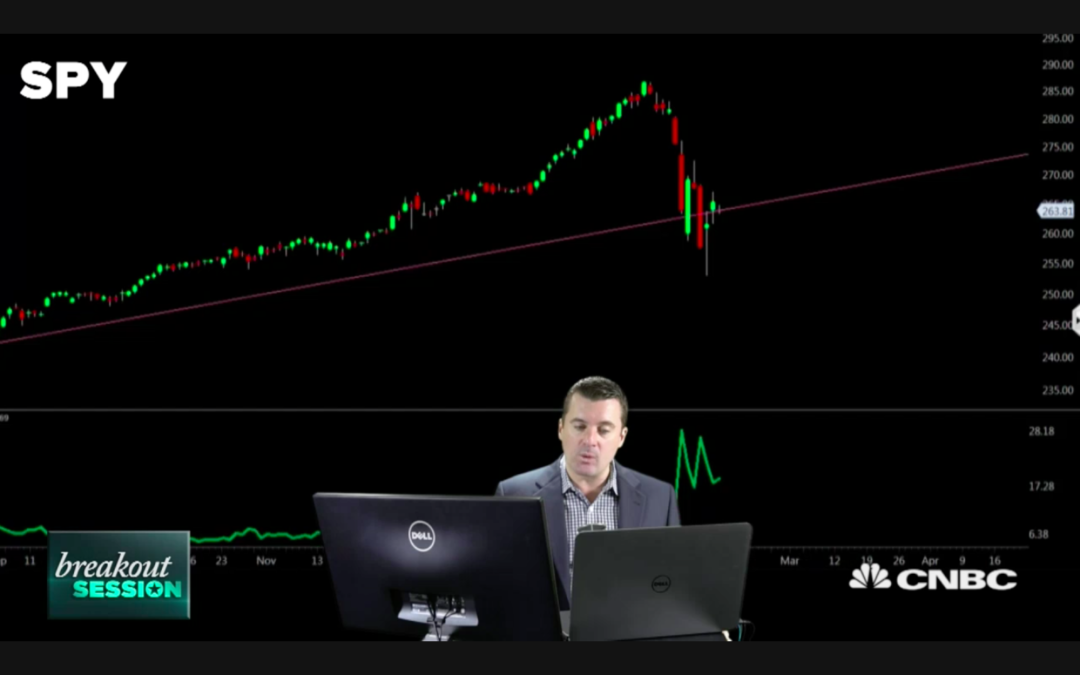

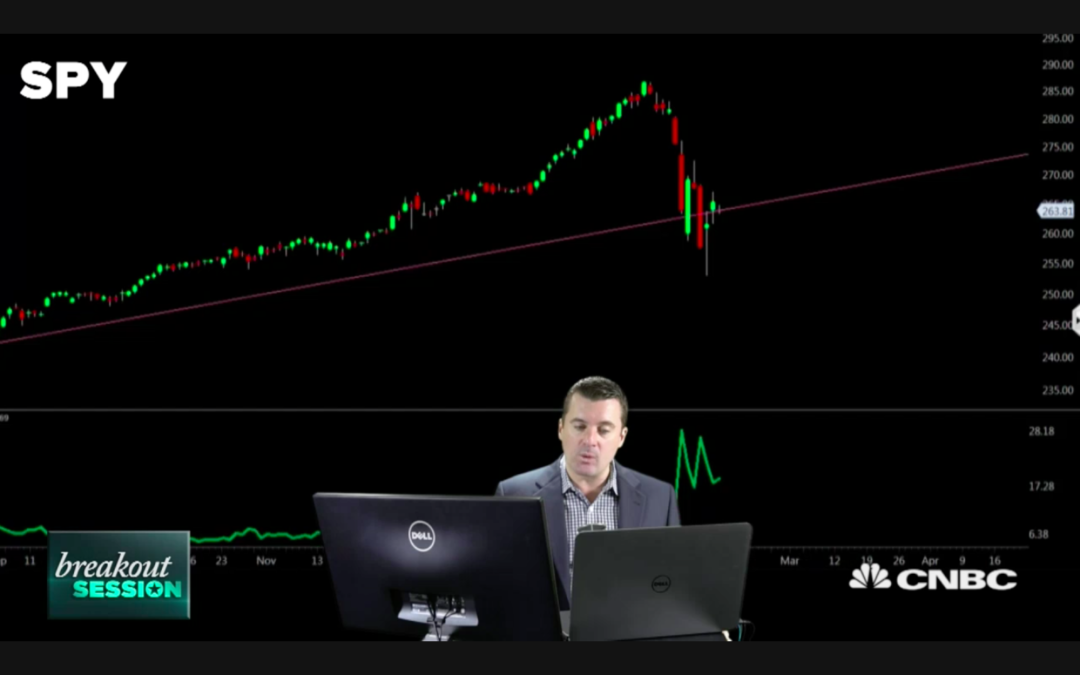

by Todd Gordon | Feb 13, 2018 | Educational Videos

Todd Gordon of TradingAnalysis.com breaks down some key levels he’s watching on the SPY. Here are the key market levels one trader is watching from CNBC.