by Todd Gordon | Dec 8, 2017 | Educational Videos

TradingAnalysis.com founder Todd Gordon has his eye on Goldman Sachs for a breakout. One big bank’s due for a big rally: Trader from CNBC.

by Todd Gordon | Dec 7, 2017 | Educational Videos

Michael Bapis, Managing Director, HighTower Bapis’ Group, and Todd Gordon, TradingAnalysis.com, look at action in CME and Cboe ahead of their launch of bitcoin futures. Trading Nation: Bitcoin futures coming soon from...

by Todd Gordon | Dec 7, 2017 | Educational Videos

Todd Gordon with TradingAnalysis.com and Michael Bapis of The Bapis Group at HighTower Advisors discuss chip stocks with Brian Sullivan. Semiconductor stocks making a comeback? from CNBC.

by Todd Gordon | Dec 1, 2017 | Educational Videos

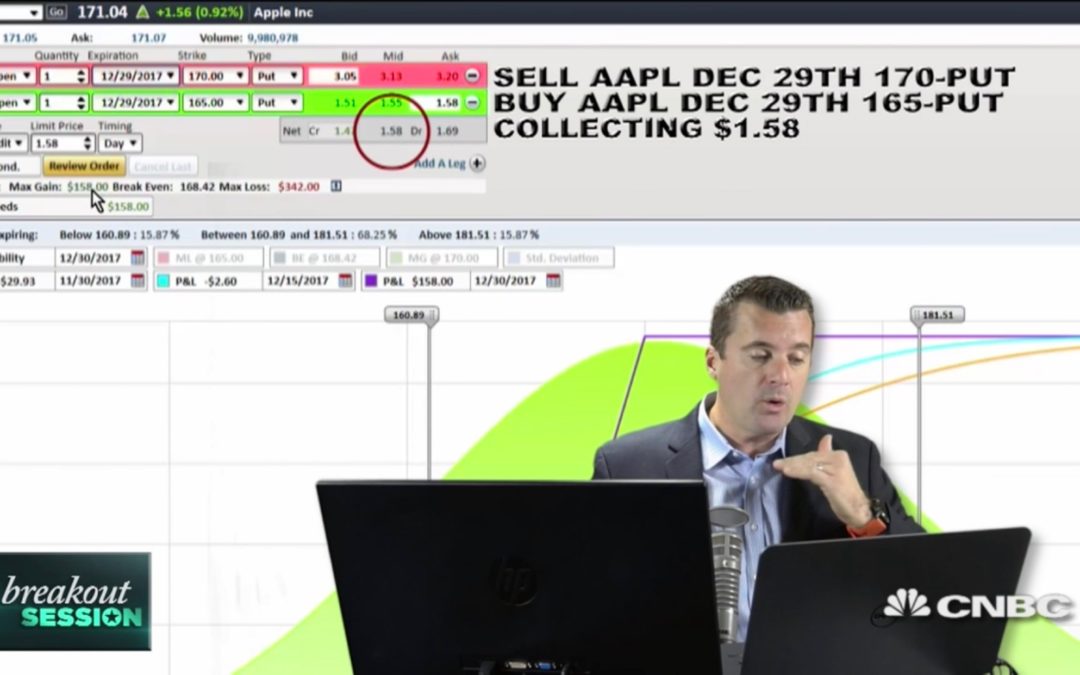

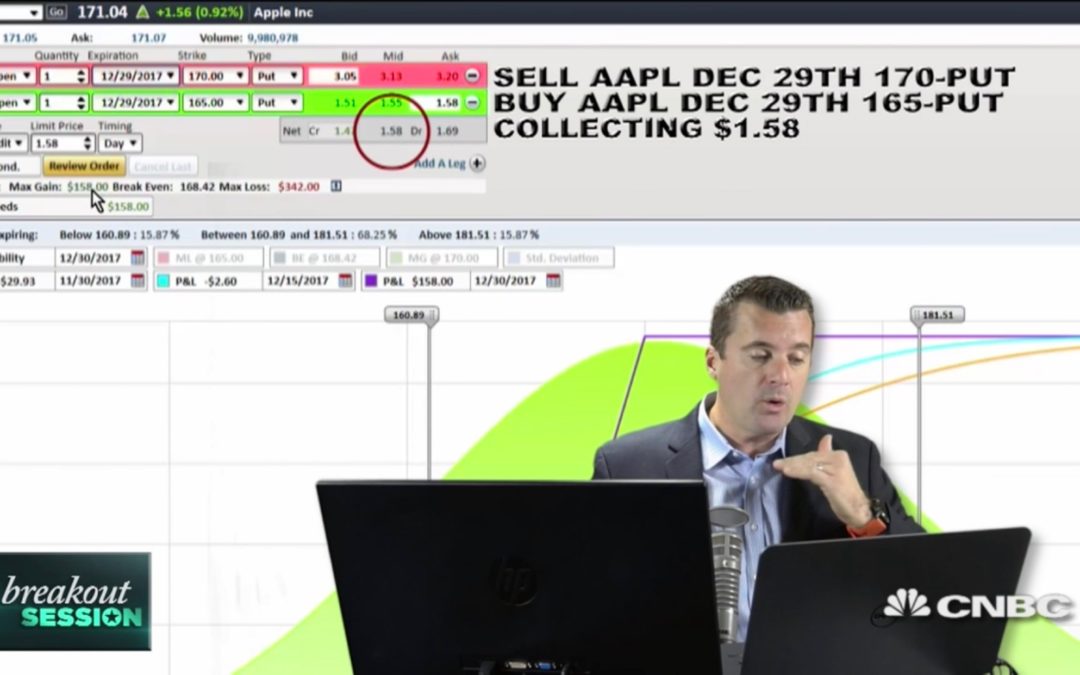

Trader bets on another rally for Apple from CNBC. Apple shares have fallen more than 2 percent from its recent high, but one would be wise to buy the dip, says Todd Gordon of TradingAnalysis.com According to Gordon, Apple has actually fallen into a “corrective...

by Todd Gordon | Nov 30, 2017 | Educational Videos

Todd Gordon of TradingAnalysis.com sees Apple staging another big rally ahead, and he’s got a way to play the tech giant for a bounce. Trader bets on another rally for Apple from CNBC.

by Nick R | Nov 30, 2017 | Educational Videos

Shares of Nvidia tanked as much as 11 percent from its recent intraday high, but Todd Gordon says this could just be the best time to buy. The TradingAnalysis.com founder said the charts are showing that Nvidia actually has room to rally before the stock enters...