Hotel Occupancy Rates Decline, But One Travel Stock May Be Able To Weather Fall Slowdown

By Todd Gordon

August 19, 2021

Todd Gordon of Inside Edge Capital Management and Danielle Shay of Simpler Trading discuss the slowdown in hotel occupancy rates and what it could mean for travel stocks in the fall.

Deere Is About To Report Earnings, And Two Traders Are Split On Where It Heads Next

Agriculture giant Deere is about to report earnings.

The company is scheduled to release quarterly results before the bell Friday, and investors are keen to find out whether its investments in robots and technology have paid off. Most recently, Deere acquired Bear Flag, a maker of autonomous tractors, for $250 million.

Deere is expected to report $4.58 a share in profit for its third quarter ended July, according to FactSet, up from $2.57 a year earlier. Analysts anticipate 31% sales growth.

But, even if the company beats expectations, Inside Edge Capital Management founder Todd Gordon says short-term headwinds could put pressure on the stock.

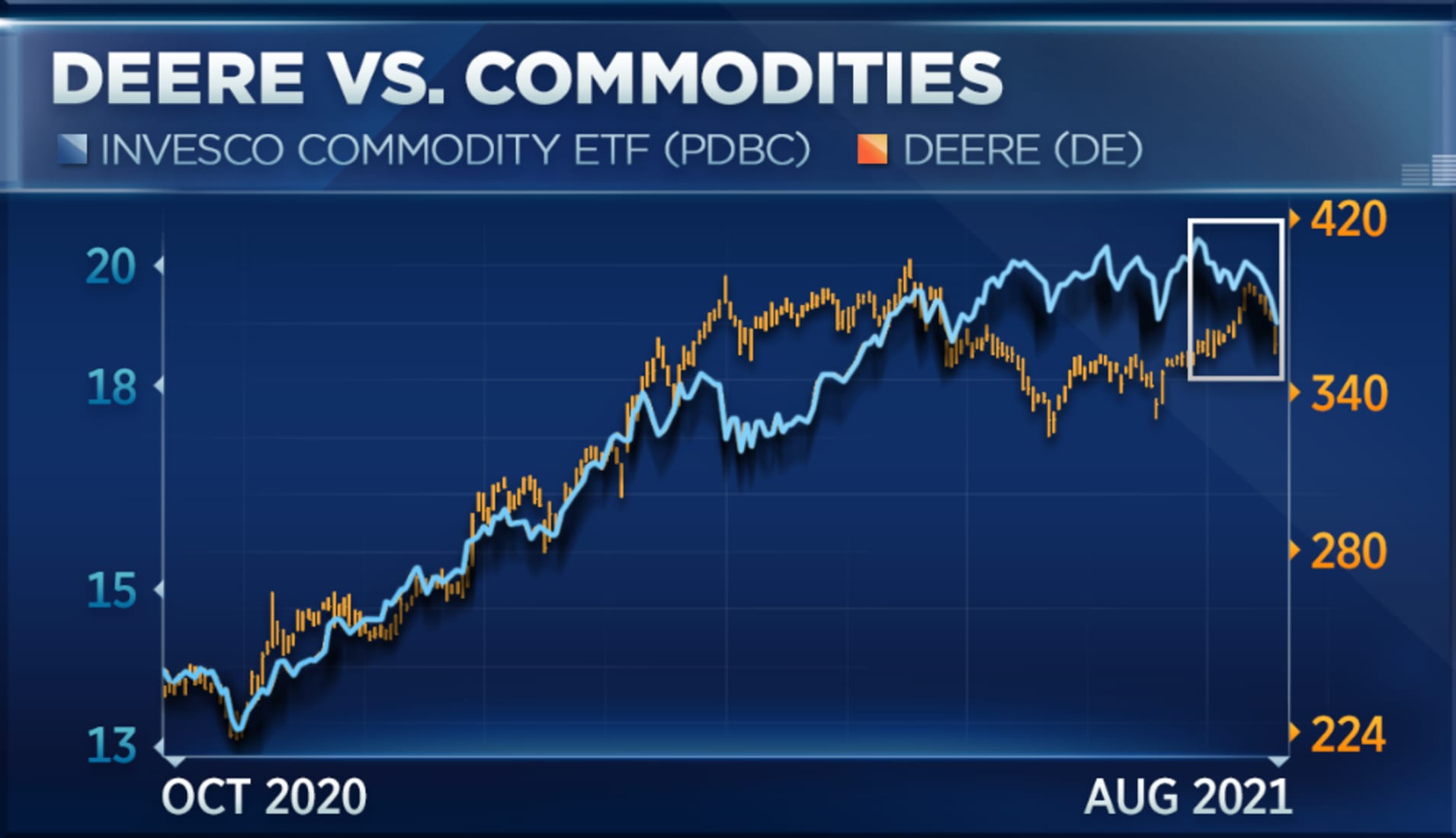

“It’s showing a pretty interesting correlation to the Invesco commodity ETF so as commodities have come off here … you’re seeing John Deere move lower. So near- to medium-term, I think we’re topping,” Gordon told CNBC’s “Trading Nation” on Thursday.

Commodity prices have eased this week as the Covid delta variant spread reset expectations for global economic growth and on the threat of a tapering Federal Reserve. The PDBC commodity ETF has fallen 4% since Monday, while Deere has slumped more than 6%.

“I think John Deere moves lower for macro reasons, fundamental as well, but not more than 5% before you can add it to your portfolio,” Gordon said.

He said that it remains a long-term buy so long as it holds above $315 and offers a fair valuation at 18 times next year’s earnings. Deere closed Thursday just below $359.

Danielle Shay, director of options at Simpler Trading, disagrees – she sees a surge out of earnings Friday.

“I love John Deere, definitely bullish the company … Six of the last seven quarters, John Deere has traded higher after earnings, they’ve smashed estimates the past couple quarters, and especially on a Thursday going into Friday trading this in the options market, it’s prime time,” Shay said during the same interview.

Shay said one strategy is to sell the at-the-money call credit spread and put credit spread, betting on a surge in implied volatility overnight.

“Ideally, John Deere pops on earnings, and I can buy back my spreads for a nice profit,” she said.

In an email to CNBC, Shay added that her overall price target on Deere is $420, and she remains long-term bullish given strength in its agricultural business. Its agriculture and turf segment makes up 63% of total revenue.

Todd Gordon

Founder and Lead Analyst of Trading Analysis

Todd has been trading as a career for the last 20+ years. His goal is to not only provide insightful analysis, but to teach people how to think and grow as professional traders. Todd is a practitioner of Elliott Wave Theory and he uses it to gain an edge in the highly competitive trading arena. In addition to trading professionally, Todd has worked as an analyst and researcher at two different hedge funds. Click Here To Learn More about Todd Gordon