Investors Could Get ‘A Gift’ If This S&P Stock Continues Its Pullback

By Todd Gordon

November 30, 2021

Investors may soon get their best chance to purchase Best Buy, Inside Edge Capital Management founder Todd Gordon said.

Nearly 40% of the S&P 500′s components including Best Buy, Disney, Biogen and a number of travel stocks are trading below their 200-day moving averages, a key indicator that tracks long-term price changes.

Best Buy could be close to a unique buying opportunity, however, Gordon told CNBC’s “Trading Nation” on Tuesday.

“The stock … has been a solid outperformer relative to the S&P since, like, 2013,” he said, citing the company’s digital expansion.

“A pullback to that $90 breakout level I think would be a gift. I don’t know if we’re going to get it. I’m certainly eyeing it.”

Best Buy traded 1.4% lower Wednesday afternoon to around $105.35.

The stock is likely to regain momentum after sustaining losses tied to its November earnings report, in which gross margins contracted and management pointed to a projected decline in fiscal fourth-quarter sales, Gordon said.

“The main reason … the stock was hit so hard in this earnings report was the margins, and I think once supply chain issues start to ease, demand increases, perhaps we go back to normal, I think Best Buy might come back, so I’m certainly watching this stock,” he said.

Boeing’s stock could also be on a path to recovery, Sanctuary Wealth’s Jeff Kilburg said in the same interview.

“It was encouraging over Thanksgiving weekend that TSA data said 20 million people traveled in the United States,” the firm’s chief investment officer said. “That’s optimism. It’s not represented in the chart.”

Boeing trading under $200 a share “does present an opportunity” given that around two-thirds of the company’s profit comes from manufacturing commercial airplanes, Kilburg said.

The stock fell nearly 2% on Wednesday to around $193.98 a share.

“At the end of the day, we have not seen Boeing really recover” from the crisis around its 737 Max airplane model, he said.

“I do think omicron, the new [coronavirus] variant that we have right now, will potentially be a waning situation which will allow more and more holiday travel,” he said. “This is an opportunity under $200 that I think you have to own.”

Trading Nation: These Traders Debate The Profitability Of Emerging Markets Amid A Strong U.S. Dollar

Jeff Kilburg of Sanctuary Wealth and Todd Gordon of Inside Edge Capital Management join ‘Trading Nation’ to discuss investment opportunities in emerging markets amid rising omicron concerns.

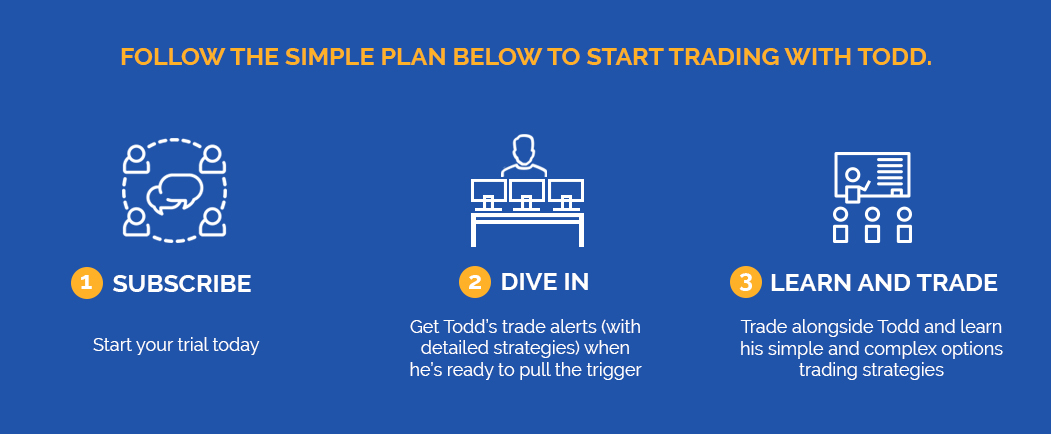

Todd Gordon

Founder and Lead Analyst of Trading Analysis

Todd has been trading as a career for the last 20+ years. His goal is to not only provide insightful analysis, but to teach people how to think and grow as professional traders. Todd is a practitioner of Elliott Wave Theory and he uses it to gain an edge in the highly competitive trading arena. In addition to trading professionally, Todd has worked as an analyst and researcher at two different hedge funds. Click Here To Learn More about Todd Gordon

Great points altogether, you just gained a brand new reader. Do you have any feedback on your most recent post though?