IPO Outlooks: Diverging Paths For Airbnb And DoorDash

By Todd Gordon

January 5, 2021

A rush of analyst calls have come out on newly public companies Airbnb and DoorDash.

Needham, the most bullish, gave a buy rating and $200 price target for both, joining Jefferies, Morgan Stanley and Deutsche Bank with optimistic outlooks.

Not everyone agrees. One of those companies has a lot better footing than the other, according to Boris Schlossberg, managing director of FX strategy at BK Asset Management. He calls Airbnb a “natural beneficiary of the post-Covid world.”

“I do like Airbnb much more than I like DoorDash,” Schlossberg told CNBC’s “Trading Nation” on Monday. “If you’re betting on the idea that the pandemic is over, then Airbnb’s business is just about to have its best days in front of it, whereas DoorDash’s business has already had its best days because of all the demand that we’ve had for takeout.”

Airbnb and DoorDash trade just above $139. DoorDash opened for trading on its Dec. 9 IPO at $182; Airbnb opened at $146 in its debut a day later.

Still, Schlossberg is wary about both for now.

“I think I’m a short-term skeptic. Let’s just start with the point that both companies are grossly overvalued, and that the only way you’re going to play this is if you have a three- to five-year investment perspective or you’re just betting on very near-term momentum to take them higher,” he said.

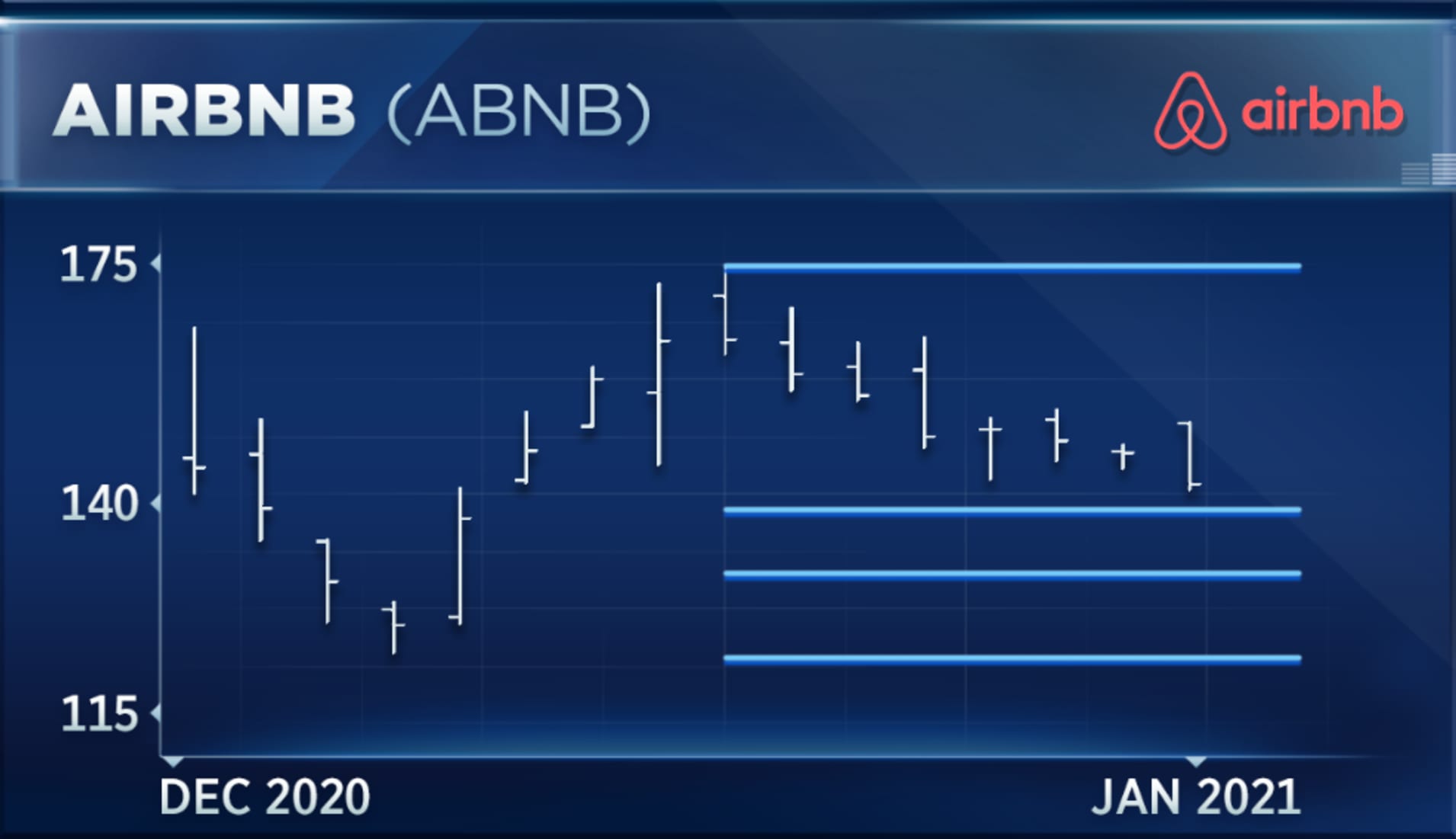

Todd Gordon, founder of TradingAnalysis.com, also sees both stocks as slightly overvalued though he’s bullish over the longer term. Airbnb, for example, should head higher so long as it can hold within its support range of $131 to $139 in the near term, he said on the same “Trading Nation” interview.

“If not, new lows should be expected,” he said.

At its bottom, on Dec. 15, Airbnb dipped to $121.50. It reached $174.97 at its peak on Dec. 22.

“I like the company longer term. It’s a high-margin business,” Gordon said. “The only real cost to Airbnb is the website and functionality. The financials showed really impressive resilience during the pandemic. Revenues dropped all the way down to about $330 million in Q2 of 2020 but came all the way back to about $1.3 billion in Q3 of 2020.”

Its third-quarter revenue was down 19% from a year earlier as the company faced weaker demand during the pandemic.

Semiconductors And Value Stocks: Traders Pick Top Trends For 2021

As markets struggle at the start of 2021, two traders share the top trends that they’re banking on for the new year.

Todd Gordon, founder of TradingAnalysis.com, sees continued outperformance for one corner of the technology sector.

“If I was to select one group [or] industry within a sector, it is semiconductors,” Gordon told CNBC’s “Trading Nation” on Monday. “It’s fairly insulated from Covid’s impact on the economy as the semiconductor evolution was in play before Covid hit and I think whether the pandemic rages on next year or if it’s managed in 2021, they should do well.”

Gordon points to semiconductor use in gaming, mobile phones, PC, crypto mining and data centers as reasons to be bullish – those trends accelerated during the pandemic due to increased remote work and online entertainment.

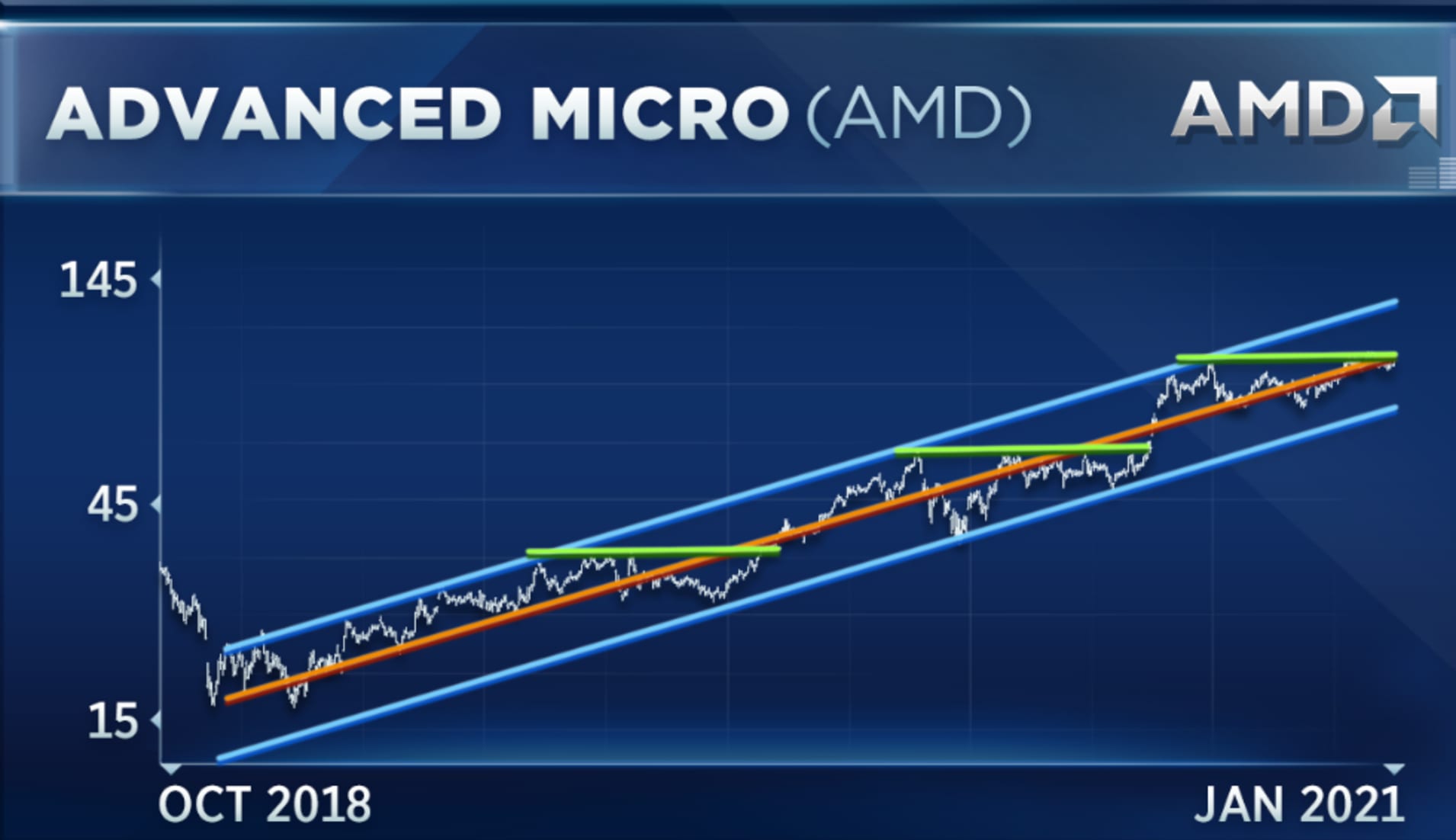

He specifically points to Nvidia and AMD as two picks that could benefit from the digital acceleration. Gordon said AMD needs to break through consolidation at around $98 to continue to rally – should it do that, he sees upside to $140. It traded Tuesday just below $92.

Nvidia, too, needs to rally through its holding pattern, according to Gordon.

“It’s taken a bit of a backseat in the second half of last year, big old triangle consolidation. If we can break through $580, the party gets started there,” he said.

Nvidia traded Tuesday at $529. It has rallied 192% off its March low.

It’s not just the high-flying tech stocks that have caught traders’ attention. Boris Schlossberg, managing director of FX strategy at BK Asset Management, sees a return to value in the next 12 months.

“This may be the year where value finally becomes valuable,” Schlossberg said during the same segment. “For the last couple of years, the absolute easiest money has been to go long Nasdaq, short Russell 2000 and Nasdaq has outperformed by a mile because basically we’ve been in a winner-take-all economy where the largest high-tech companies have been able to essentially enjoy monopoly profits.”

Now, he predicts Big Tech undergoing harsher regulatory scrutiny under a Biden administration which could put a crimp on their outperformance.

“More importantly, it’s valuation. It’s really never different anytime. And I think when you look at valuation basically at any kind of historical precedent especially the ’99 run-up … anytime you are enjoying triple digit P/E, it always ends,” said Schlossberg.

Cost-cutting during the pandemic should also give the Russell 2000 companies that have survived greater operational leverage.

“They’re going to outperform on that basis. So when you look at it from every possible angle, I think this may be the year where value finally does come back,” Schlossberg said.

The small cap-focused IWM Russell 2000 ETF has rallied 25% in the past three months.

Disclosure: Gordon holds AMD and NVDA.

Todd Gordon

Founder and Lead Analyst of Trading Analysis

Todd has been trading as a career for the last 20+ years. His goal is to not only provide insightful analysis, but to teach people how to think and grow as professional traders. Todd is a practitioner of Elliott Wave Theory and he uses it to gain an edge in the highly competitive trading arena. In addition to trading professionally, Todd has worked as an analyst and researcher at two different hedge funds. Click Here To Learn More about Todd Gordon