NDX Butterfly in profits

By TradingAnalysis

November 7, 2019

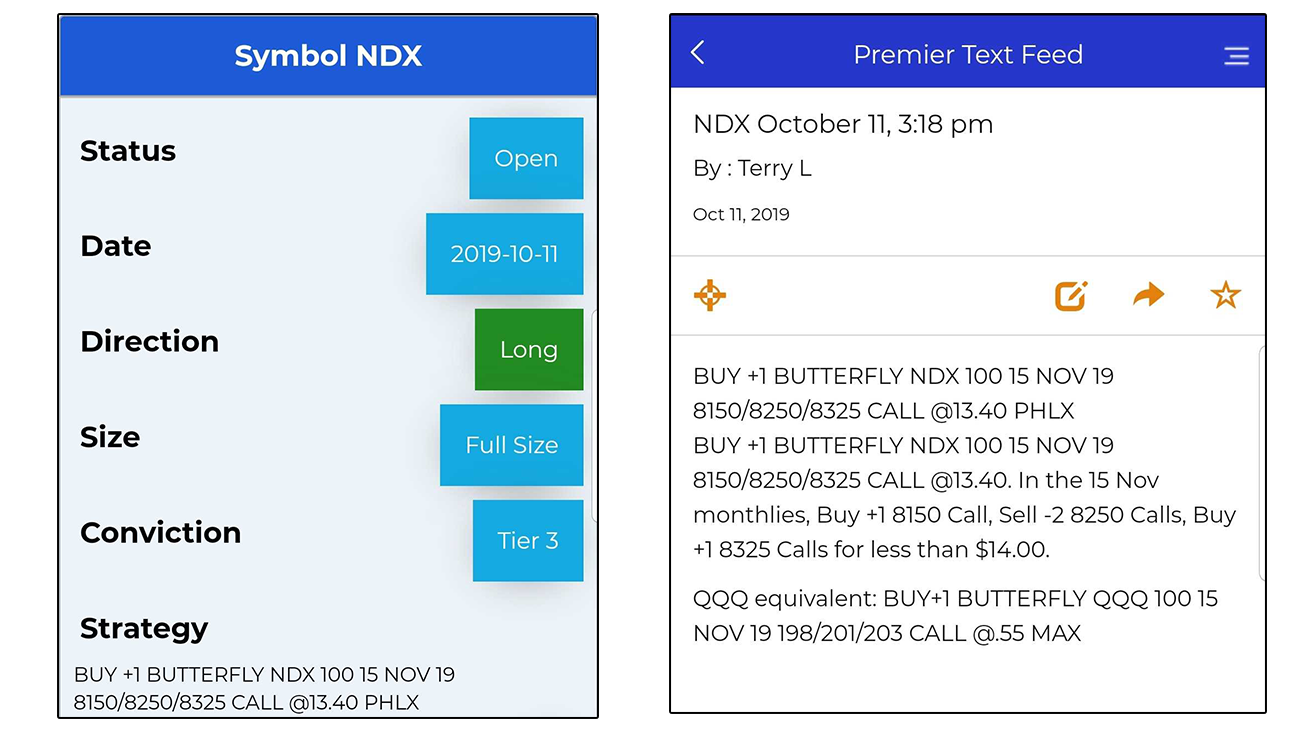

We are always practicing what we preach here at TradingAnalysis. Early in October we identified a potential market breakout and initiated an NDX Butterfly for $1,340 per fly. This trade alert was sent out to all of our customers on October 11th. Here is a picture of that exact Alert.

Below you can see a breakdown of the risk profile associated with the position as Todd Gordon walks us through the trade.

After putting on the trade, the market started to move slightly lower and against our position. During this time Todd Gordon kept in constant communication with our members, keeping them updated on what we were looking for in the markets and why we were still holding the trade. In our October 23rd Elliott Wave Wednesday Livestream, Todd reviews the risk profile and the Elliott Wave count we utilized to execute this trade.

Although the position initially went against us, we stuck to our interpretation and outlook on the markets, managed risk and booked half profits on November 1st at $25.55 vs the $13.40 entry! Additionally, we ended up with more than a triple on the remaining position (after already taking our cost basis off the table) as the NDX reached our desired 8250 target, setting an all-time intraday high of 8721.82 on November 7th.

Finally, In our last Elliottwave Wednesday todd discussed what should be done in the NDX position. Maximize profits or take the winner…

As we still hold on to this position. Look to next week’s update, on what happens to the NDX Butterfly Trade.