Retail Wreck Rolls On, But These Names Could Hedge Against Weakness

By Todd Gordon

January 3, 2020

Retail stocks are tumbling on the heels of their best year since 2013.

The XRT retail ETF has fallen nearly 2% in the past two days, weighed on by department stores such as Macy’s, Kohl’s and Nordstrom among others.

There are a few names that could buck the trend, according to two traders.

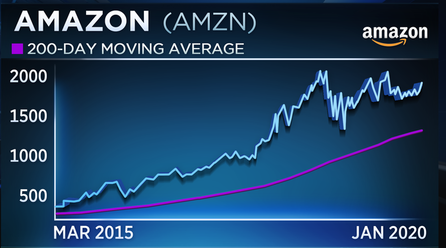

“I’ve got to go [with] Amazon and the catch-up trade that we’re seeing,” Todd Gordon, founder of TradingAnalysis.com, told CNBC’s “Trading Nation” on Thursday. “We’ve just seen a period of consolidation. This is a five-year chart. We’re just now moving off the lower end of support and it looks like we still have resistance levels that we need to chop through at the $2,000 mark.”

“If we get up through $1,850, no reason we shouldn’t be able to go up and close that gap and, of course, that puts us back up to $2,000. I hold the stock, I added to it two weeks ago, I continue to like it,” Gordon said.

Gina Sanchez, CEO of Chantico Global, said retail headwinds will continue in 2020, but agrees that Amazon is one sure bet.

“The challenges that face the retail industry will continue to face the retail industry and I would say that as we go into 2020 we’re probably going to see continued consolidation,” Sanchez said during the same segment. “Even though companies like Macy’s are spending a lot of money getting their e-tailing game, they’re running to stay in place and I think Amazon is really the way to play that which is to just go digital.”

Gordon also likes Lululemon, a stock up 26% in the past six months. The shares, which are not part of the XRT ETF, have managed to lead as one of the top performers in the Nasdaq 100. Gordon said Lululemon will not meet resistance until $300, which implies a nearly 30% rally from current levels.

Sanchez sees another name that could be an outlier among the retail downturn.

“The other way to play that is to go cheap – TJX has actually had a really good run and I think that will continue as well as a lot of retailers right now are really staring into the abyss of bankruptcy,” she said.

TJX, which owns TJ Maxx, is up nearly 40% for the past 12 months. By comparison, the XRT ETF has risen 11% over the same time period.

Disclosure: Gordon holds AMZN and LULU.

Todd Gordon

Founder and Lead Analyst of Trading Analysis

Todd has been trading as a career for the last 20+ years. His goal is to not only provide insightful analysis, but to teach people how to think and grow as professional traders. Todd is a practitioner of Elliott Wave Theory and he uses it to gain an edge in the highly competitive trading arena. In addition to trading professionally, Todd has worked as an analyst and researcher at two different hedge funds. Click Here To Learn More about Todd Gordon

How to make my second blog my default one on Tumblr?