Santa Claus Rally – And Beyond?!

By Todd Gordon

December 23, 2022

Here’s a follow up to yesterday’s video discussing the outlook for the S&P 500 into the targeted corrective resistance. We understand the challenges and obstacles this economy faces to return to growth mode in 2023 and don’t want to appear as if they are lost on us. But we are seeing evidence that a return to growth and higher equity prices are possible, despite the mixed signals we’re getting from the Fed and long-term US yields and inflation expectations. We see technical evidence that we are testing support and combined with such a broad awareness and expectation of the ‘coming recession’ we can’t help but think sentiment is peak bearish, hedges widely established, and equity positioning very light. Do these inputs open the possibility of a sizable corrective rally and possibly beyond? Or, is this simply another case of ‘don’t fight the Fed’ and hop on board a move to lower equity prices to stamp out inflation? This remains to be seen.

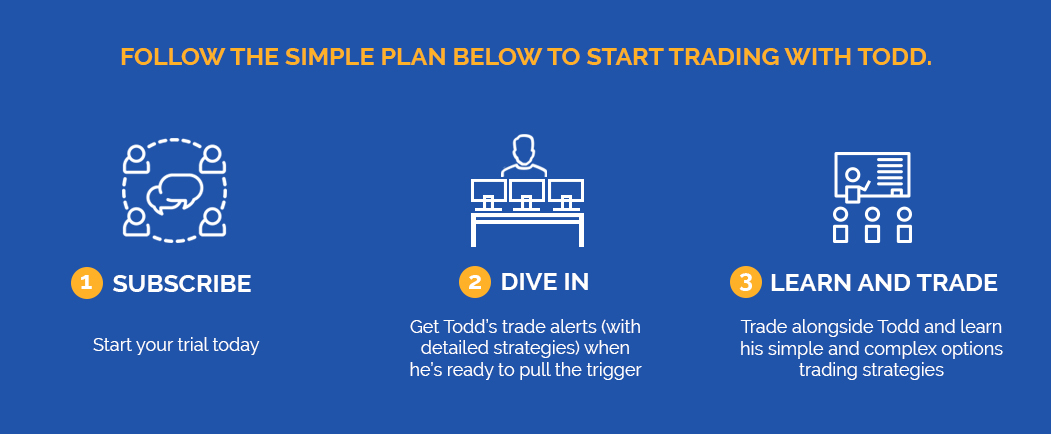

Todd Gordon

Founder and Lead Analyst of Trading Analysis

Todd has been trading as a career for the last 20+ years. His goal is to not only provide insightful analysis, but to teach people how to think and grow as professional traders. Todd is a practitioner of Elliott Wave Theory and he uses it to gain an edge in the highly competitive trading arena. In addition to trading professionally, Todd has worked as an analyst and researcher at two different hedge funds. Click Here To Learn More about Todd Gordon

I enjoyed your informative presentation. Always good stuff.

I believe like you a short term rally is in order next week. Then Watch out 3200 -3300 here we come sometime in the future.

Only if we could get a better handle on timing of market down moves. I haven’t made the time to study Fib and how they work in time. I understand the levels with upside and downside moves.

Merry Christmas