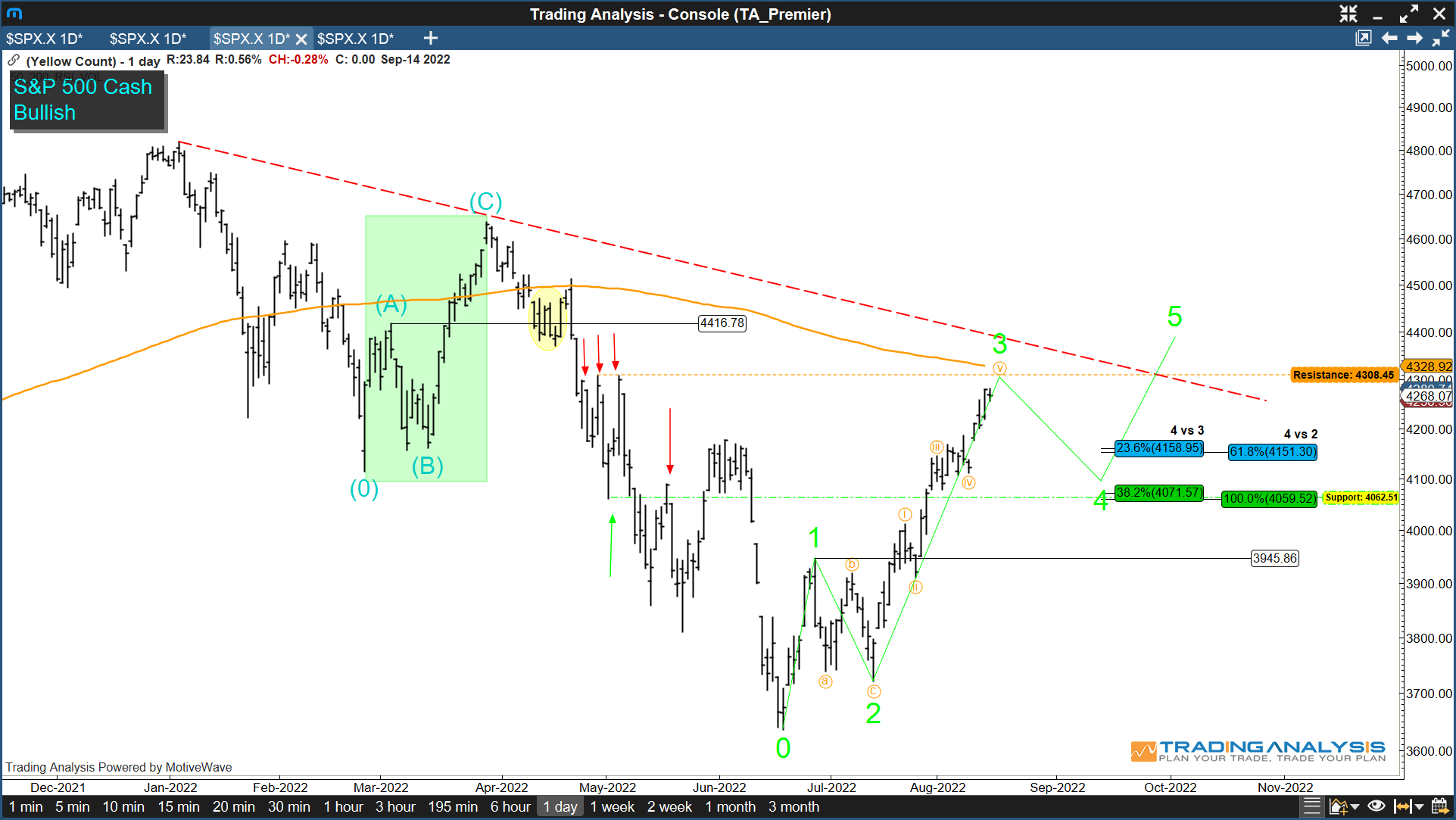

S&P 500 Approaching Resistance

By Bennett Tindle August 15th, 2022

Stocks have been moving sharply higher as of recent, with the S&P 500 up nearly +18% from the June 17th low.

Although we continue to remain bullish, we don’t yet have evidence of a “trend-establishing” move off the major index lows.

Just look back to the +12% rally that unfolded between Feb 24th and March 30th. It finished the rally in 3-waves, aka a “corrective” wave structure.

Also, take note of the 4416.78 price label that marks the March 2nd high.

When the S&P 500 rejected the March 30th high and moved south of 4416.78, it invalidated the uptrend, which confirmed a move to new lows.

We have the exact same setup in development now, with “3-waves” or price-swings up from the June 17th index low.

Except this time we don’t expect the pattern to invalidate the uptrend. We expect it to CONFIRM the uptrend.

How do we confirm the uptrend? With corrective consolidation!

When does that consolidation begin? Likely in the next 25-50 points…

Although this uptrend has been relentless, we are rapidly approaching overhead resistance.

That resistance includes the 200day moving average, as well as the late April/early May area resistance (4308.45).

So be ready for a pullback in the markets, and keep your eyes on the hard-right-edge of the chart as the move develops.

If we are right in suggesting the June 17th low as the end of the correction, then markets should enter sideways-to-lower consolidation back down to 4060 – 4100 to confirm support.

If alternatively this HAS been a “corrective” rally, similar to the Feb 24 – Mar 30 move, then watch the pullback for signs of acceleration. A move under 3945.86 (June 28th high) will invalidate the uptrend and confirm a move back to the June 17th low.

Only Elliott Wave analysis can provide us with such clarity of trend and key decision levels.

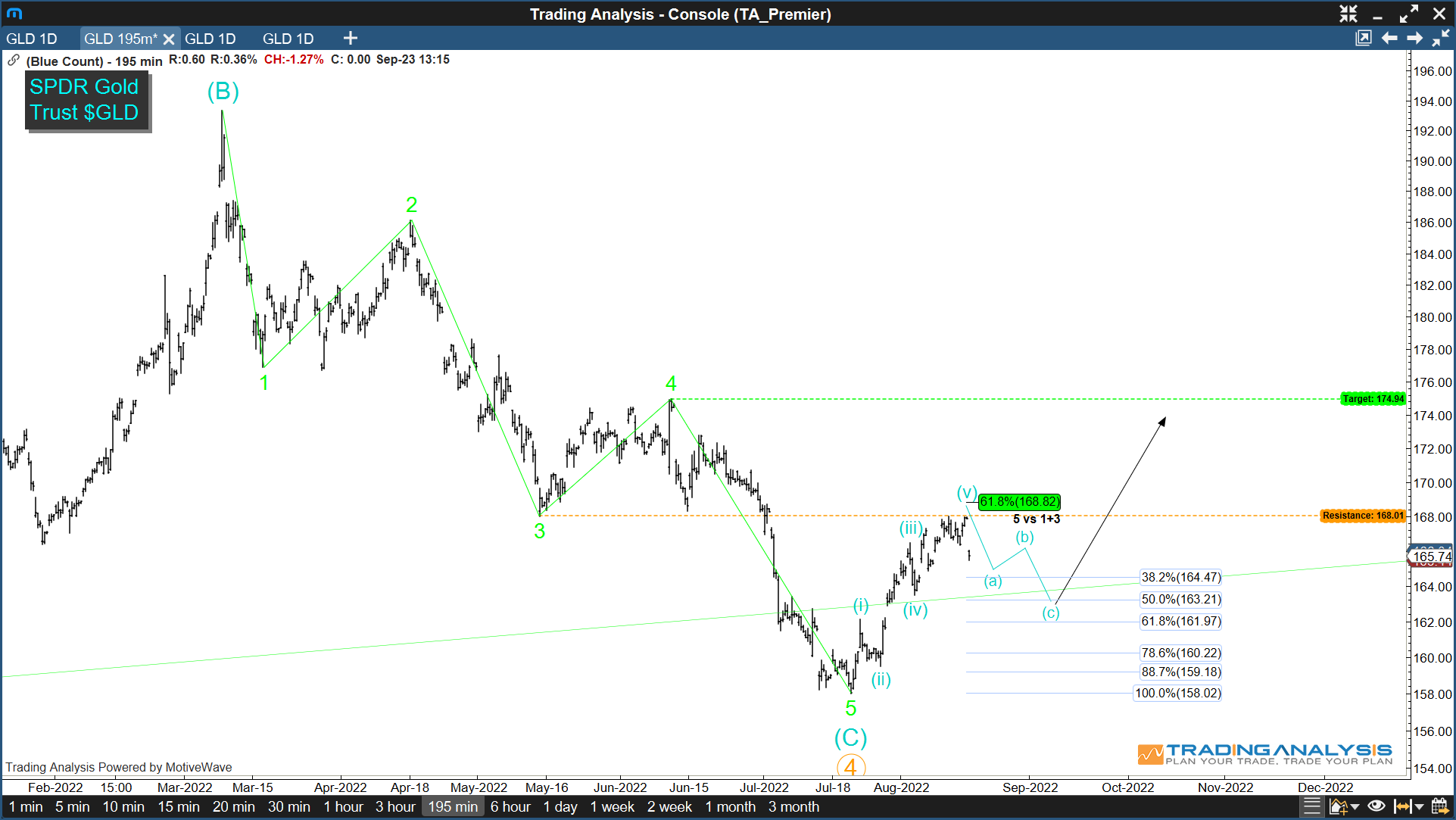

Gold Support Delivers Trend Wave

We recently reviewed support in Gold near 1650 – 1675 that we expected to hold.

Gold established a 1678 area low back in July and has since moved up +8%.

We are now approaching overhead resistance with a completed 5-wave rally, meaning the next 3-wave pullback should present a tradeable low.

Although this could be the start of a larger uptrend in precious metals, we will take the more conservative approach and look to trade up to near $174.94 in $GLD once the 3-wave pullback we have forecast completes.