Starbucks Paces For Worst Year Since 2017. Here’s The Level It Needs To Break To Avoid More Pain

By Todd Gordon

December 8, 2021

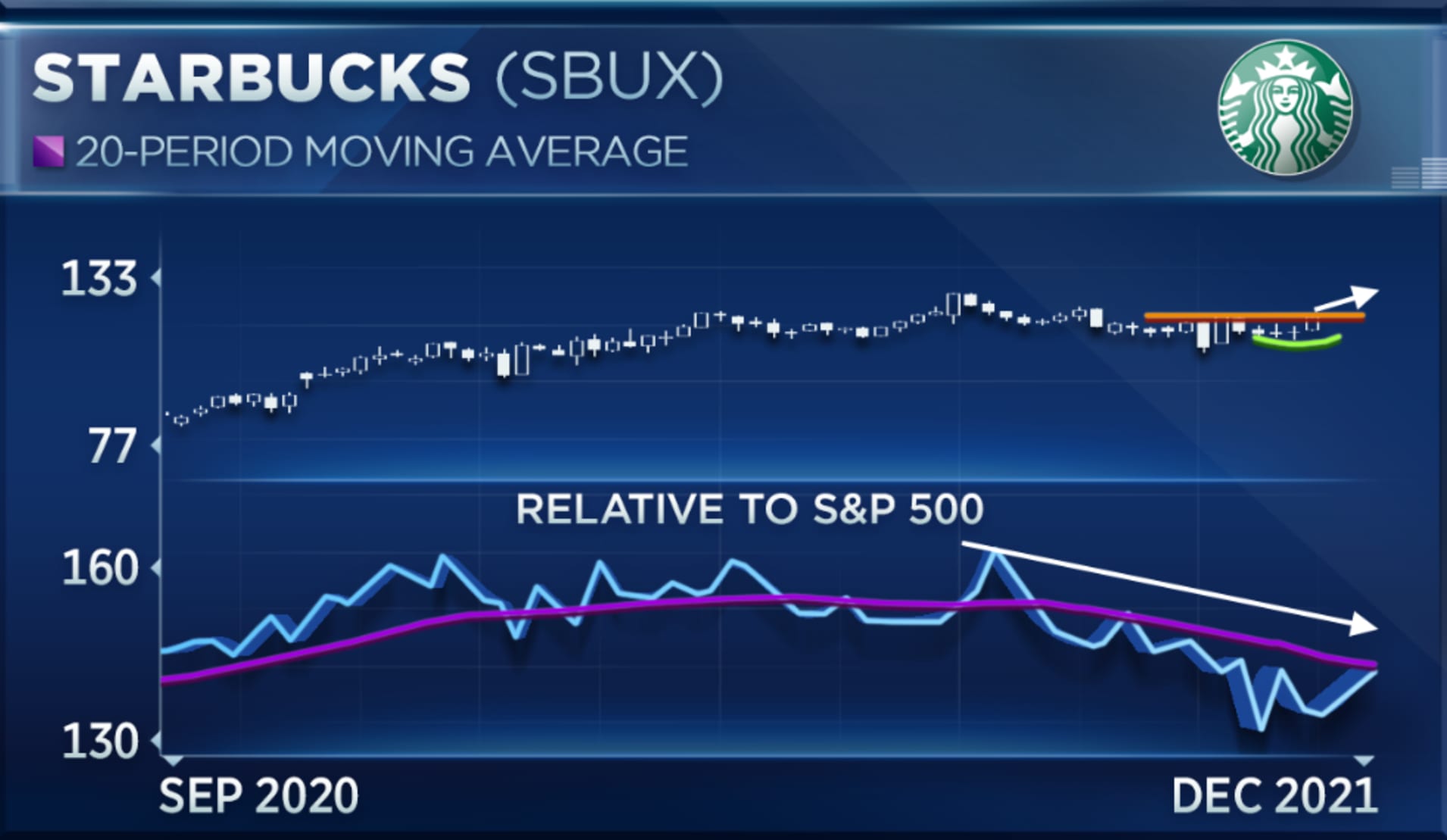

The latest breakout in shares of Starbucks is reaching a potential breaking point, Todd Gordon says.

Having spent the second half of 2021 unable to recapture its July all-time highs, the coffee chain’s stock is up more than 6% in the past week amid subsiding fears around the coronavirus omicron variant.

MKM Partners upgraded Starbucks to buy from neutral on Tuesday, expressing high hopes for the company’s long-term profitability and productivity despite some short-term obstacles. MKM also raised its price target for the stock to $130 a share, nearly 12% above Tuesday’s closing levels.

Starbucks’ latest push higher “sort of sets up a technical development,” after months of relative underperformance, said Gordon, founder of Inside Edge Capital Management.

“If we can get through 118, it looks good,” he said. “We might see a resumption of the uptrend.”

Starbucks shares ended trading up just over 2.5% at $116.26 on Tuesday.

But it’s going to take more than an improving technical picture for Gordon to buy into Starbucks.

“I’m worried about the fundamentals,” he said, pointing to the company’s debt levels, its exposure to the strengthening rental market and the difference between its valuation and analysts’ growth expectations.

“They’re expected to make about $3.44 a share next year. They made $3.24 this year. So only 6% growth priced in, yet they’re trading 30 times forward earnings,” he said. “I don’t see it as being a part of my portfolio in the near future.”

Potential unionization could also cause a near-term wrinkle in Starbucks’ growth plans, but MKM may have a point, Chantico Global founder and CEO Gina Sanchez said in the same interview.

“They have a healthy margin and in theory they have enough pricing power and enough growth expectations that they should be fine suffering that in the short term,” said Sanchez, also chief market strategist at Lido Advisors.

“MKM brought that out and said, ‘Hey, they might be in for some short-term pain, but the longer-term expectations are there.’”

Trading Nation: Vacasa Goes Public As Expedia And Airbnb Climb

Gina Sancheze, Chantico Global, and Todd Gordon, Inside Edge Capital Management, discuss the travel industry with Seema Mody as Vacasa goes public.

Todd Gordon

Founder and Lead Analyst of Trading Analysis

Todd has been trading as a career for the last 20+ years. His goal is to not only provide insightful analysis, but to teach people how to think and grow as professional traders. Todd is a practitioner of Elliott Wave Theory and he uses it to gain an edge in the highly competitive trading arena. In addition to trading professionally, Todd has worked as an analyst and researcher at two different hedge funds. Click Here To Learn More about Todd Gordon