Tesla Is A ‘Tech On Wheels’ Company, And That Gives It Room To Run

By Todd Gordon

September 10, 2020

Tesla may be down 30% in the past week, but don’t count the stock out, says Ascent Wealth Partners managing director Todd Gordon.

The value of the stock, a frequent focus in the bull-bear debate, depends on how an investor views the company, Gordon said Tuesday on CNBC’s “Trading Nation.”

“The main difference between how bulls and bears view Tesla is whether they value it as a traditional auto company or a technology company. If you’re trying to assign valuation on Tesla based on the conventional automobile industry, of course the stock is going to look expensive,” Gordon said. “We don’t see Tesla as an auto company but more as a ‘technology on wheels’ kind of company.”

Traditional automakers General Motors and Ford trade at eight and 27 times forward earnings, respectively. By comparison, Tesla trades with a 129 times multiple — far higher than the Ford and GM but more in line with some of the high-flying momentum stocks such as Amazon.

Even after a nearly 300% rally in 2020, Gordon says the stock’s technical setup suggests limited further downside.

“If you look at the chart, coming from early 2020 at the March low, we actually have a nice uptrend channel here that has begun to offer support around the $355 level,” said Gordon. “Tesla has really just pulled back, and we might be looking at support here. If this line is broken, not all hope is lost. You do have support down here at about the $280 level as well.”

Tesla closed at $330.21 on Tuesday. A move to $280 implies roughly 15% downside.

The electric vehicle maker’s fundamental story points to even more growth in the long term, adds Gordon. By his calculations, electric car sales average 40% year-over-year growth and account for only 2.6% total global car sales. The key for Tesla, he says, is in the Chinese market.

“There’s a strong sort of embrace for electronic vehicles in China, which … is the largest auto market in the world. Tesla remains by far the most popular company there despite local competition,” Gordon said.

While increasing competition from the likes of Nio and Nikola has given some buyers pause, Gordon sees Tesla as having a superior competitive edge.

“We think Tesla is so far ahead in terms of battery and software technology, kind of going back to our point that Tesla is more like a ‘technology on wheels’ company,” he said. “Tesla has both the longest-range batteries and the largest charging network infrastructure, with the latter being something that will be hard to replicate for new electronic-vehicle market entrants, so they have a major competitive advantage there.”

For wannabe Tesla investors though, Gordon does have a warning. The stock, he says, is vulnerable to major bouts of volatility. So buyers need to position size appropriately to mitigate risk.

Disclosure: Ascent Wealth Partners holds TSLA.

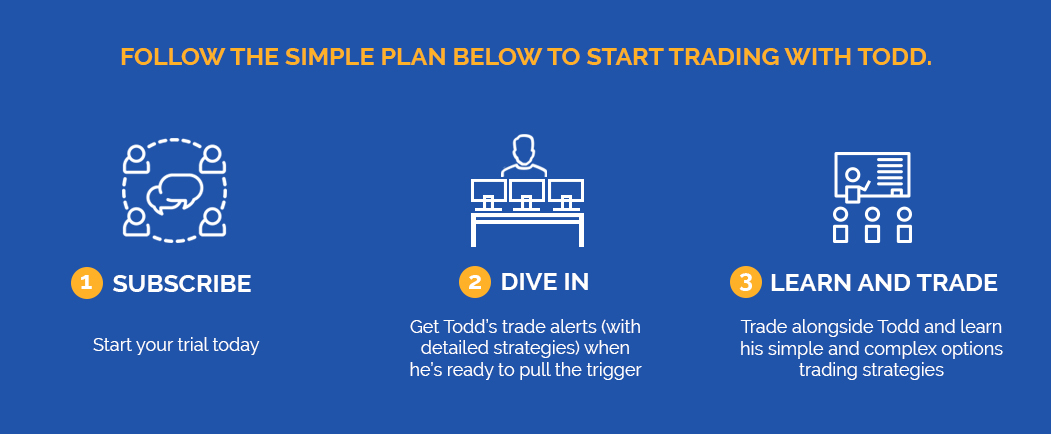

Todd Gordon

Founder and Lead Analyst of Trading Analysis

Todd has been trading as a career for the last 20+ years. His goal is to not only provide insightful analysis, but to teach people how to think and grow as professional traders. Todd is a practitioner of Elliott Wave Theory and he uses it to gain an edge in the highly competitive trading arena. In addition to trading professionally, Todd has worked as an analyst and researcher at two different hedge funds. Click Here To Learn More about Todd Gordon