[Updated!] – The Most Important Chart In The Market

By Bennett Tindle August 30th, 2022

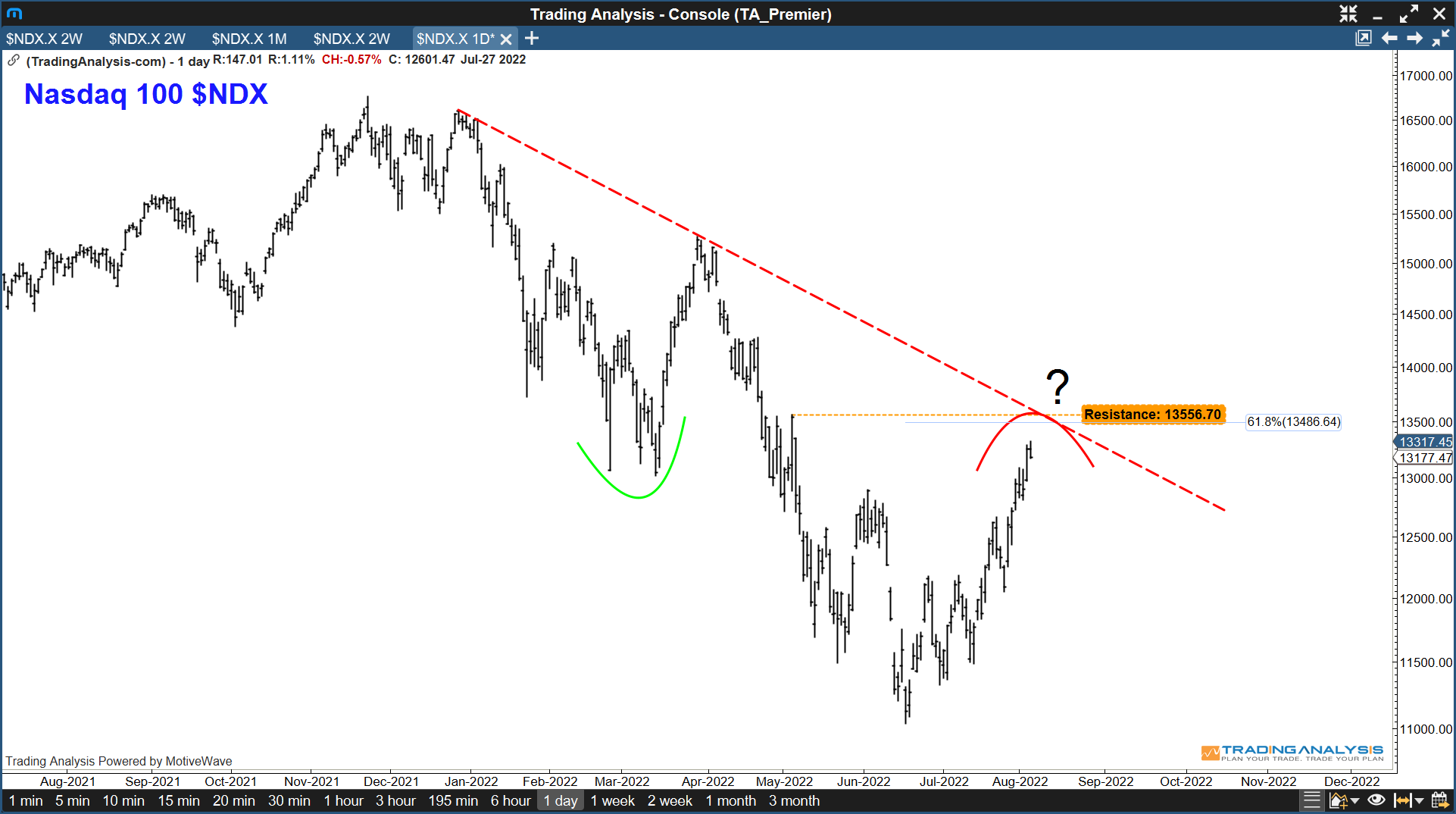

Do you remember this chart from our August 4th email?

This is where we expected the Nasdaq 100 to run into trouble.

Specifically, we had noted a confluence of technical resistance near 13,500.

Then last week we emailed you to warn you about the expected turn lower in the markets.

The Nasdaq 100 has since declined over 10 percent.

And we are now approaching the most important market decision of the year..

Have we started a new bull market, or has this been a corrective rally?

Where We Go From Here

Looking to developments in the $NDX today, we see it trading just above the most important pivot point of the year.

That level? 12,175.98.

If we can maintain support above 12,175.98 and turn higher, we should see a break of overhead resistance going into Q4.

If alternatively we see the $NDX break south of 12,175.98…

… WATCH OUT BELOW!

Under 12,175.98 and we ARE going to new lows.

Mark my words.

$IVW Growth vs $IVE Value Daily Rotation

Earlier in the month we also reviewed the positive rotation back into Growth that started at the end of May.

Value moved rapidly to the southwest, indicating a loss of relative strength and momentum.

Simultaneously Growth moved rapidly to the northeast, indicating increasing relative strength and momentum.

Yet as the indexes reached overhead technical resistance, we started to see clear hesitation in the rotation back into Growth.

As you can see in the animation above, that hesitation has since resulted in a hook back to the southwest for Growth, and back to the northeast for Value.

This suggests the rotation back into growth may have been premature, and a breakdown in the markets should be expected. That said, we’ll let the market decide.

More on this tomorrow morning on our weekly livestream!

While we’d love to see you join our services and see what we have to offer, we want you to be prepared either way! So save the charts, and keep them handy as markets prepare to establish trend for the remainder of Q3, if not the remainder of the year!

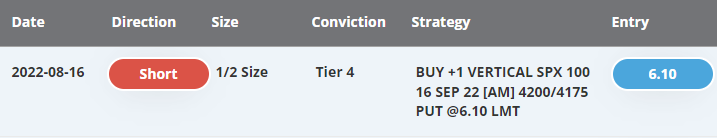

Shorting The August 16th Index Reversal

Not only was I able to warn you about the expected decline, but I was also able to call the turning point with our clients as it happened, going short in the process!

…I even called the turning point on Twitter! Click here to follow me for more updates!