Wealth Management Update and Investor’s Greatest Fears…

Todd Gordon July 1st, 2021

Hello Traders and Investors,

Todd, Flash Crash, Gordon here. I hope this finds you well and enjoying the second week of summer. We’ll touch on a few things this evening, including a little bit about life, markets, risk and the pursuit of return. Towards the end, I’ll share a common theme that I’ve been hearing about the biggest fear investors are facing today.

It’s been a while, and for that I’m sorry. I’m just back from a three week absence that included spending father’s day alone, working on my tan, and reading a 600-page textbook with approximately 1,000 practice test questions sprinkled in between. This was in preparation for the Series 65 securities law exam, which I successfully passed last Wednesday! This exam is one of the steps required before I’m able to officially launch a wealth management business. This has been a career-long goal and the time is near. I spent the first 20 years studying markets, trading markets (mostly my own capital, along with other people’s money -opm- for a hedge fund on Wall St.), and talking about the markets on CNBC. Now that this pirate has seen 40, it’s time to evolve and spend the back half of my career building a small wealth management business that caters to a small number of qualified investors that I hope to call friends.

I have another call tomorrow, and certainly many more to come, with the group of people who are making this transition possible. The transition has taken longer than I hoped and I do feel sorry for keeping those ready to go waiting, but progress is being made. I can’t help but reflect, get a little sentimental, and maybe carry on with the Jimmy Buffett references. Did you know I’ve been to about 20 Buffett shows? You haven’t been? Put it on your bucket list. A verse from the song ‘Last Mango in Paris’ comes to mind:

“I had a damn good run on Wall Street With my high fashion model wife

I woke up dry beneath the African sky Just me and my Swiss Army knife”

My life has kind of followed the song verse. I did have a nice run on Wall Street, I still have my high fashion wife with model-esque looks (but no model contract), and I just woke up beneath the rural Saratoga sky, just me and my trading computer. But it wasn’t happenstance, it was all part of the plan. Time to go simple, move back to my roots in upstate NY with my family, and build my next digital business.

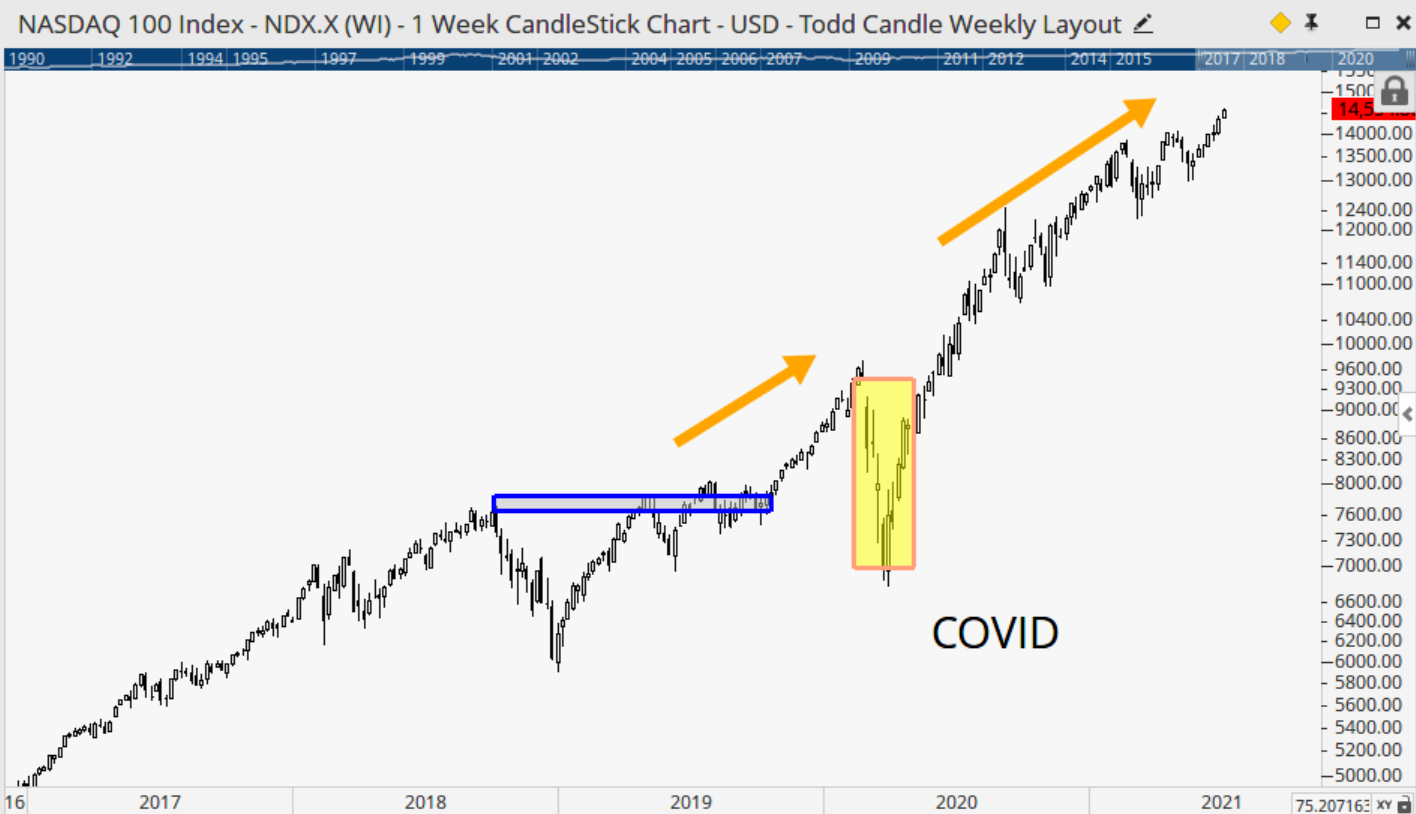

On to markets. Well, they’re ripping as we emerge from the pandemic. Personally, I’m of the belief that we were in a rip-roaring 3rd inning tech rally prior to the pandemic. The pandemic took hold, and the Fed and Government stepped in with multiple trillion dollar liquidity injections to combat economic shutdown. It not only stabilized the shutdown, but I think it only accelerated the dynamics at work previously including the adoption of technology enabling a more connected work and home life through better consumer technology and massively increasing bandwidth. The pandemic didn’t create this work at home / stay at home theme driving technology shares higher, it briefly interrupted it, and then accelerated it.

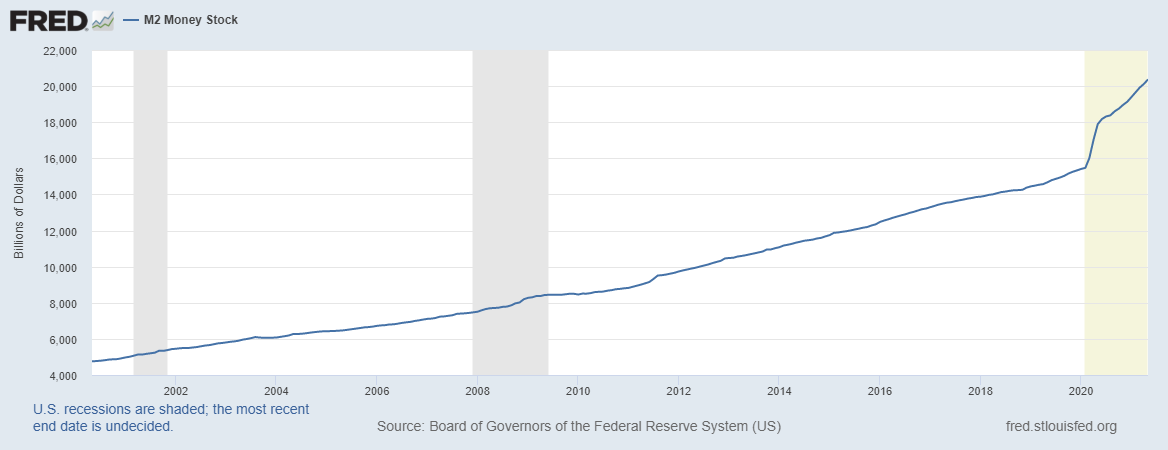

On the heels of the massive stimulus “they”, as in the collective “they” who are always talking and seem to garner a large captive audience, somehow managed to convince us that inflation was finally on our doorstep and like the kid from “Better Off Dead” who really wanted his $2.00, there was no stopping him from coming through the door and robbing us blind. Granted, the newly updated definition of M2 has exploded, but I’ve been listening to people trying to convince us that inflation was going to be inevitable, face-ripping, and unstoppable ensuring gold above $5k since QE1 when I was a young, single, hedge fund trader in my TWENTIES during the Global Financial Crisis. Still waiting.

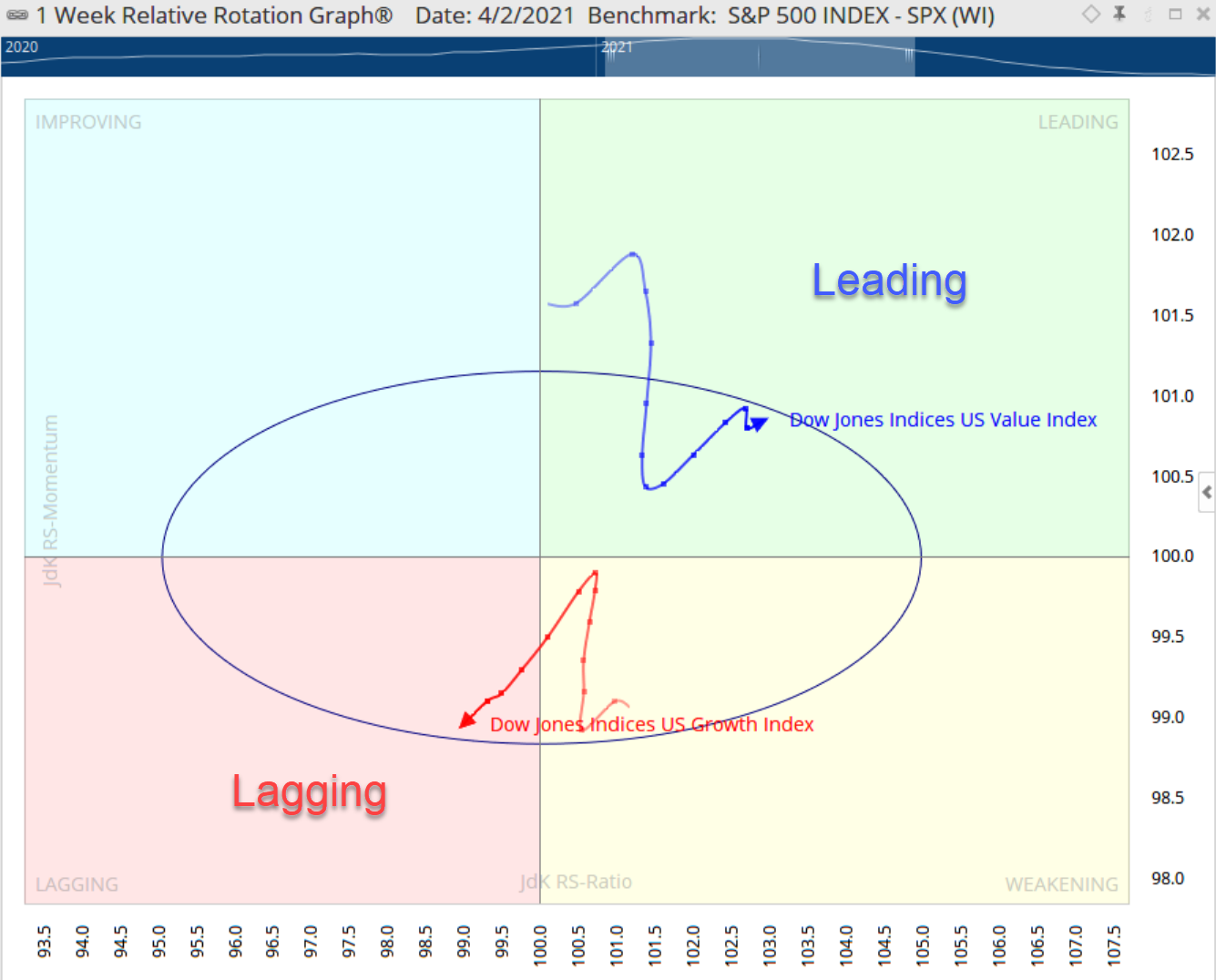

We did have an uptick in inflation, which caused the markets to give pause to the roaring technology rally with lofty valuations and indications of windfall profit quarters years down the line, and turn to value stocks. Value stocks were the beaten down names hardest hit by the pandemic shut down with proven track records and steady dividends, but without the growth prospects of new age tech companies like Tesla, Nvidia, and Docusign.

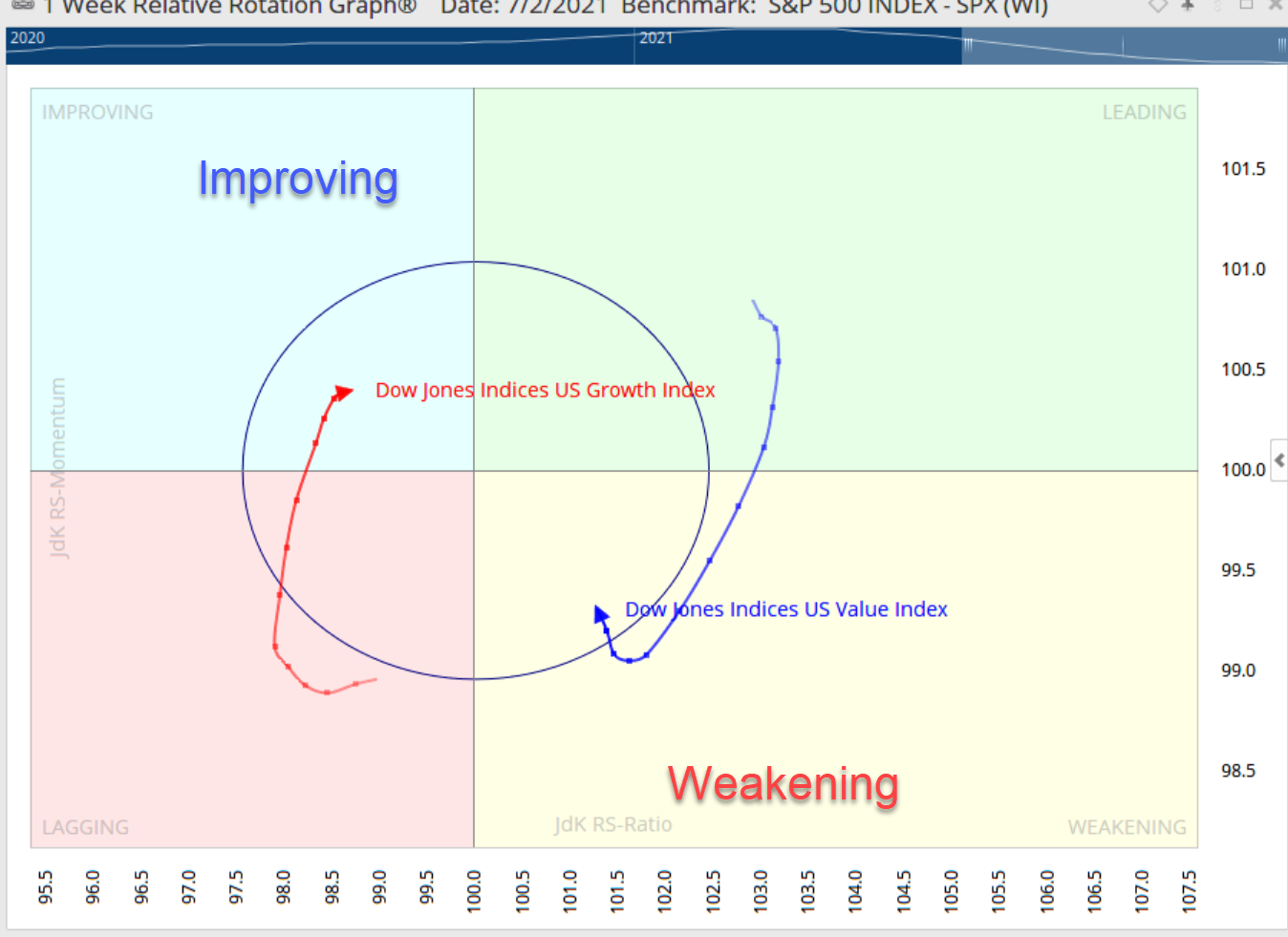

See the argument here is why pay crazy high multiples and have to wait for the promise of profits years down the line when all of a sudden inflation-sensitive stocks that make and produce stuff like industrials, materials and energy, can pay you now. The relative rotation graph below shows how during Q1 of ‘20 the value stocks rotated into the leading quadrant while the growth stocks rotated out and into the lagging quadrant. “They” again screamed from the antenna towers and through the fiber lines that the growth trade was dead and value was back with a vengeance.

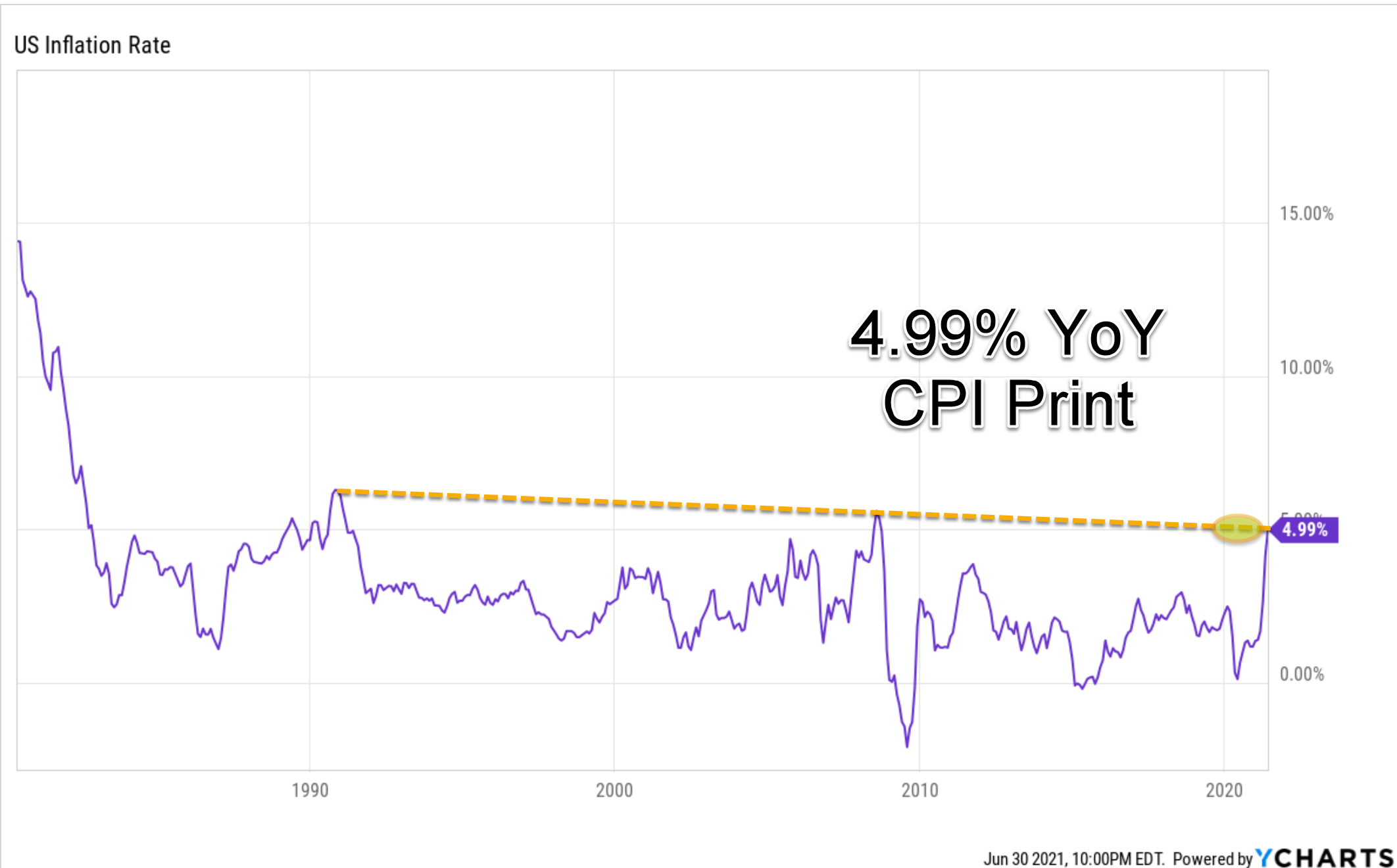

Inflation has indeed ticked up and the inflation-crazed survivalists who are convinced the Fed is a terrorist organization have proclaimed the end of the buck is near. On June 10th I tweeted ahead of the June CPI reading that we needed to hit a 5% Y/Y print to break the 30-year downtrend in CPI . We hit 5% on the button and right on the trendline. No breakout yet.

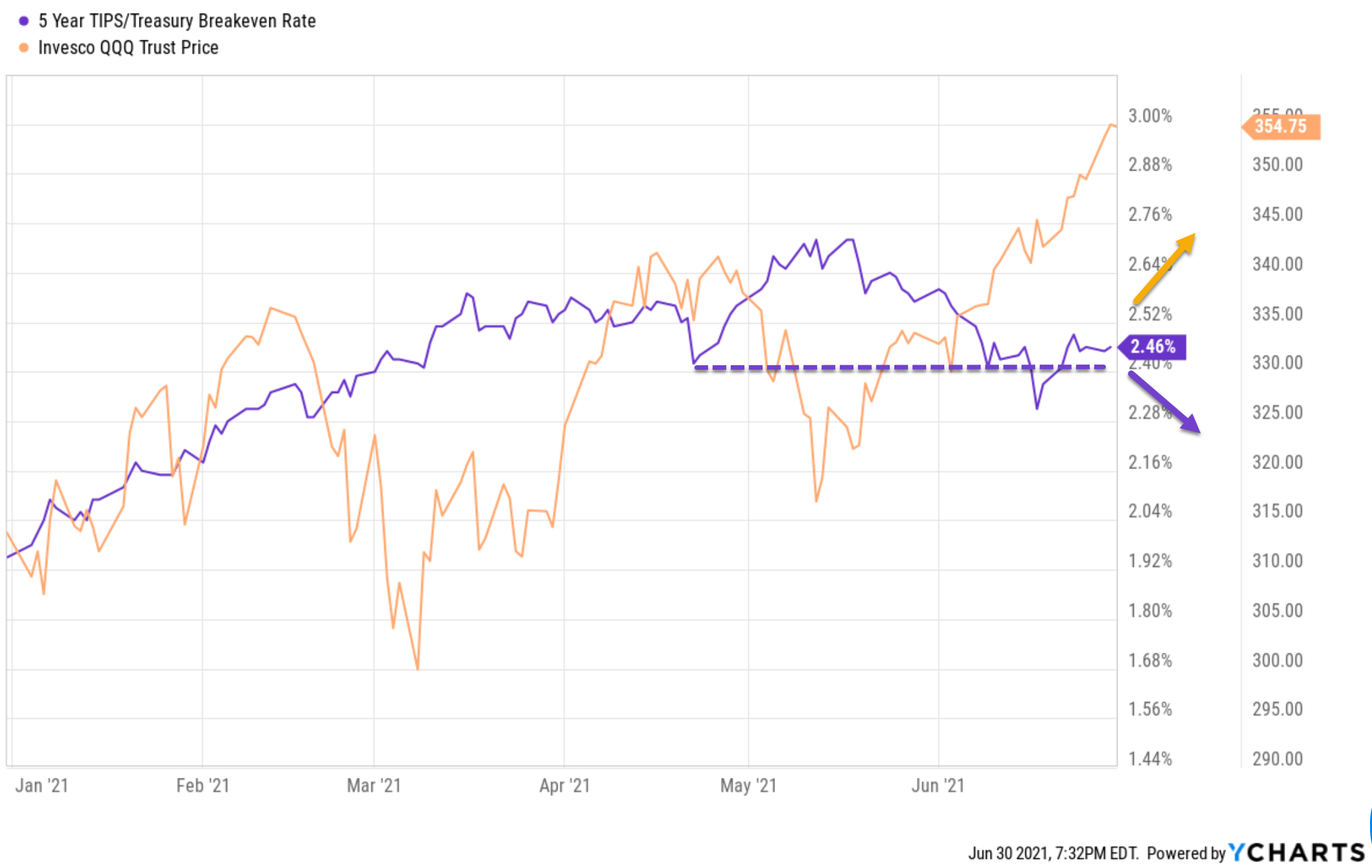

In that same tweet I also showed the correlation of the 5-year treasury inflation protected securities (TIPS) overlaid on the QQQ’s. Since the pandemic lows you would see that higher inflation expectations led to higher NASDAQ 100 prices, but just recently in light of the inflation scare of 2021 the two charts are trading inversely. In that tweet I showed the TIPS breakeven testing vulnerable support at 2.47% projecting a failure, along with a higher QQQ chart in orange. The June CPI report did not break the downtrend, inflation expectations have receded, and as a result the NASDAQ has REGAINED its leadership position. Here’s the updated chart.

All is returning back to normal now as the value trade is heading down into the weakening quadrant while the growth trade is heading into improving and probably back into the leading quadrant.

There are, however, inflationary forces out there as a result of the government’s actions. Take a look at soft goods including food, housing, and other transitory supply pressures like semiconductor shortages hurting the auto industry, among others, causing increased pricing pressures. But bottom line, interest rates have been declining (deflationary / disinflationary) on the 30-year US treasury since I’ve been out of diapers, approximately 1982 (born in 1979). 30-yr US yields are nowhere near breaking their 40-year downtrend channel.

Deflationary forces result from an aging population demanding yield for longer, the globalization of the workforce that will do it for lower costs, and most of all technology improving profit margins and displacing many in the workforce. I think interest rates will continue into their 4th decade to probe lower, continuing to give us negative effective real yields, and possibly even negative nominal yields, forcing us further into the stock market to find a return.

If you would like more information and would like to consult about Todd and Team managing your financial future, please visit the Ascent Wealth Partner website.

But what if I am wrong? I’ve been a trader for twenty years, I’ve made a career of knowing how to be wrong. What if inflation moderates here are around 3-6% and the Fed does increase the Federal fund rates? That will certainly hurt stocks in the short-run, but I don’t think it will derail the bull market as a Fed that’s no longer highly accommodative will certainly assuage inflation concerns and stocks will continue to rally. This will allow the technology ball game to continue into the middle and later innings, when eventually the robots revolt and wipe us out anway.

Turning back to the technicals this year, there have been massive triangle consolidations forming as large cap technology rotated out of favor. I highlighted this in Apple and the NASDAQ on CNBC a few weeks back that markets were rotating back into growth and the 5-wave triangles should break higher.

There have been 5 prior examples of a 5-wave consolidation pattern over the past 10-years leading to a breakout with significant follow through. The percentage movements post-triangle thrust range from 12% all the way up to 101% until the next triangle consolidation sets in. We just broke from the most recent triangle and guess how far the NASDAQ has rallied while growth rotates back into favor? 4% so far. We at TradingAnalysis have Elliott Wave models that put the stock market significantly higher from here. We also have models that are very bearish to be balanced.

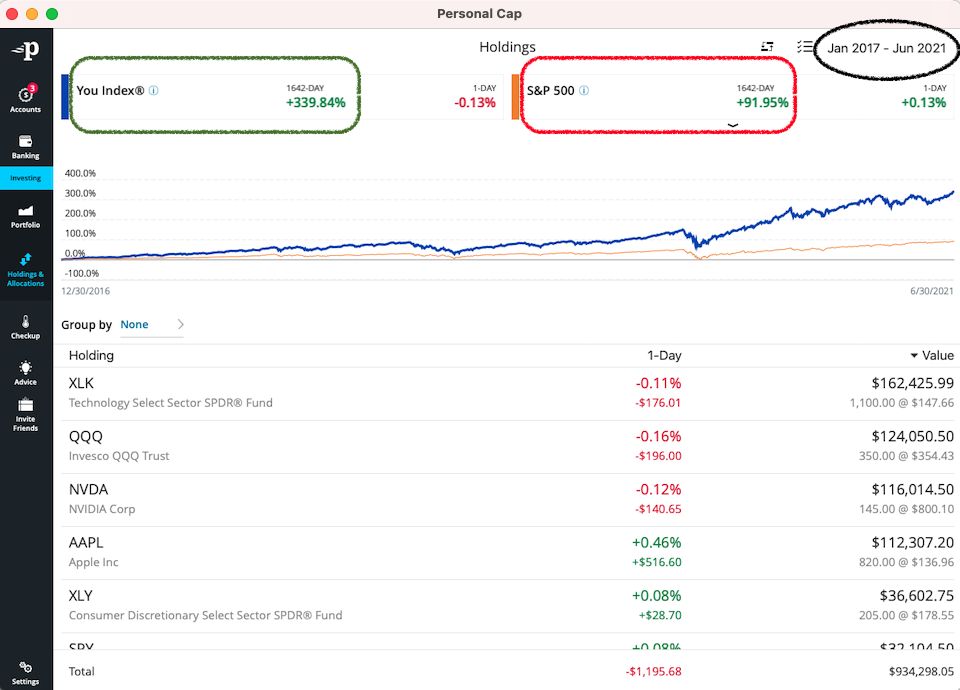

So don’t get me wrong, I’m not in complete inflation denial. There are increasing prices out there, but it’s not a result of increasing demand chasing a fixed amount of supply causing prices to rise. It’s an increasing demand from a global population increasingly coming online demanding a greater amount, and improved technologies, that will enhance our lives. Personally I’ve been very long technology led by positions in XLK, QQQ, AAPL, and NVDA in my portfolios. I hate to put this out there and am not exactly sure how Personal Capital computes my returns with contributions to my accounts, but my results in my own accounts over the last 4 ½ years are below via the “You Index” compared to the S&P 500.

My portfolio is currently 58.76% technology, 16.49% consumer cyclical, and 13.40% communications. This is a highly aggressive portfolio, but I’m in my early 40’s, and plan to earn for about 30 more years in my new venture. I am not NOT AFRAID of volatility and corrections, but I welcome them. I will do my best to hedge them with SPX and NDX put option strategies, but I will also be adding to my positions with stock. This portfolio is not appropriate for a 65-year old newly retired worker with $700k in assets for retirement AND I’M DEFINITELY NOT PROMISING I OR ANYONE ELSE WILL GET THESE KIND OF RETURNS IN THE FUTURE. Actually it was a little irresponsible to be so long in technology.

However, as I’m talking to people who are looking to grow with me, one common theme that keeps popping up is that many investors have been underinvested in this bull market following the global financial crisis and are coming to regret it in the form of inferior returns. People are afraid of moving too heavily into the market at the wrong time just before a massive correction and putting their principal at risk. I have my suspicions, but I think the collective “they” out there trying to grab your attention (as I am currently doing as well) dressed in scary bear market suits have cost you valuable basis points. Each person’s risk tolerance is certainly different due to income, age, and personal situation, but for the vast majority of investors out there it’s not loss of principal you need to be so scared of. Even with moderate 2-4% price level increases in pricing levels with a booming economy, it’s loss of purchasing power that should keep you awake at night. The traditional 60% equity, 40% fixed income portfolio recommended for decades by the old school wirehouse managers is falling out of favor. There are very little returns to be found in fixed income anymore. The only way to truly protect against moderate inflation of Y/Y 2-4%, or god forbid much worse, is by holding stocks. If the stock market rallies, interest rate increases, and resulting inflationary pressures begin to force the Fed’s hand into tightening monetary policy, we need to realize that the easy money is over and the old-economy value, staples, utilities, real estate, healthcare, and fixed income might have their turn in the sun again. But to keep up with eroding purchasing power, the ample liquidity flowing in the economy now and in the foreseeable future, the on-going bull market, we need to have greater stock market exposure.

Hope that helps,

Todd Gordon.

Great article Todd!

Nice job breaking down market environments aligned to developing and managing a strategic plan that’s appropriate to an investor’s unique situation.

The reality is most investors lack the basic knowledge needed to choose the right investments at the right time for the right reasons. They merely pick from the slim list of offerings provided in their 401k plans and accept the resultant performance, good or bad.

Keep up the good work.

Congrats on the 65, all the best in your new venture!