UBER has come a long way in a short period of time as a publicly traded company. The initial offering was less than 5 years ago in May 2019 (but founded in 2009) as an on-demand cab service. Many doubted the business model and the valuation the company has carried and maintained even to this day. But the company has evolved rapidly in those 5 years to a business model that’s not just digital ride hailing but also includes delivery, freight, and advertising. It still commands a high valuation creating skepticism for investors, but the fundamental and technical picture I believe has improved dramatically and will likely remain in my portfolio for the foreseeable future. In fact, I’m looking to add to my position in the Tactical Alpha Growth model at my RIA Inside Edge Capital.

In the most recent earnings report on Feb 7th they reported GAAP EPS of $0.66 vs $0.15 expectations on $9.94 billion of revenues versus $9.77 billion expectations. For all of fiscal year 2023 they made $0.87 in earnings and analysts are looking for 40% EPS growth to $1.22 in earnings in 2024. That figure gives us a forward multiple of 63 times earnings. Not cheap!

I think heavy valuation reflects the company’s vision of autonomous transports for both transportation and delivery. The company has partnered with several autonomous driving companies including Nuro, Waymo, Aptiv, and Hyundai. They are also collaborating with Toyota to move further into autonomous ride sharing and are using Nvidia’s AI technology to power the computing systems in their autonomous driving efforts.

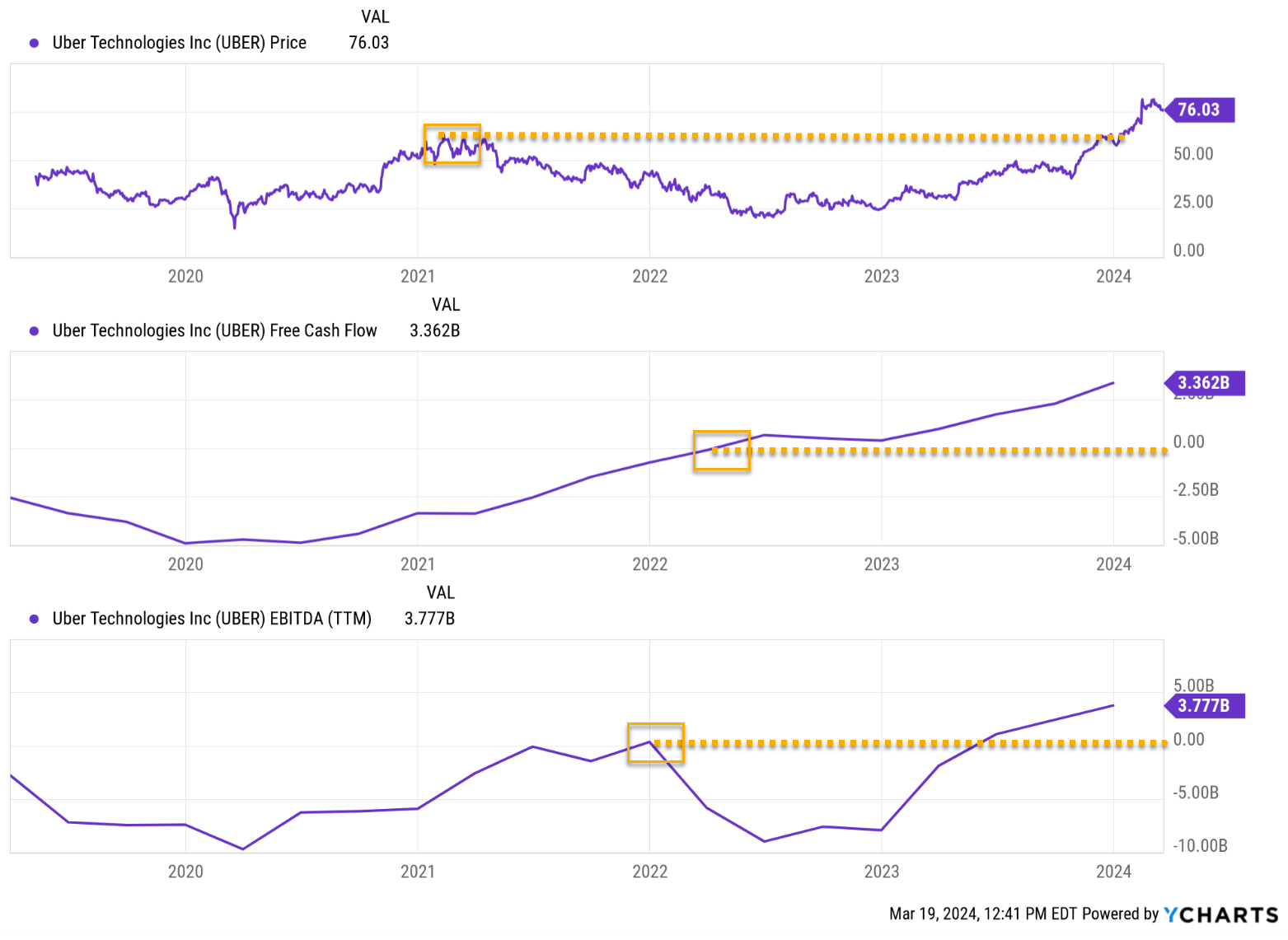

But it’s not all a promise for a bright future that drives the bloaty valuation, it’s also reflective of the amazing turnaround the company demonstrated regarding free cash flow. Looking at the free cash flow the company was burning as much as $5 billion in 2020, $3 billion in 2021, but in 2022 actually went to a positive $2 billion in free cash flow. It approached positive EBITDA in 2022 and achieved it in 2023.

The positive cash flow as a result of fewer ride incentives offered and a smaller marketing spend as the brand recognition began to carry the company. How often do you say “do you want to Lyft to the restaurant”? In fact, in about 10 minutes I’m going to suggest to my wife that we “Uber” to the restaurant to celebrate her birthday!

Turning to the technicals, the daily chart shows a symmetrical 9.9% decline that was equal to the 9.9% decline from Q4 of 2023. It’s amazing how often these symmetrical percent moves happen in the charts when you start to look for them.

The anticipated support level was $73.53 and we closed today at $77.05. We hold a 3% allocation of UBER (established 1% in Feb ‘23, added 1% in Nov ‘23, added 1% in Feb ‘24) and am looking to add another 1-to-2% in the coming week. I want to see how the broader market and specifically technology handles this volatility in the semiconductors before we move on it.

(DISCLOSURES: Gordon owns Uber personally, in his research business TradingAnalysis.com, and in his wealth management company Inside Edge Capital Management, LLC Charts shown are MotiveWave.)

Todd Gordon

Founder and Lead Analyst of Trading Analysis

Todd has been trading as a career for the last 20+ years. His goal is to not only provide insightful analysis, but to teach people how to think and grow as professional traders. Todd is a practitioner of Elliott Wave Theory and he uses it to gain an edge in the highly competitive trading arena. In addition to trading professionally, Todd has worked as an analyst and researcher at two different hedge funds. Click Here To Learn More about Todd Gordon