Indexes Down, Apple Up?

By Bennett Tindle September 20th, 2022

If you were following the market today, you likely saw the +1.57% close in shares of Apple.

All while the Technology sector, as well as the benchmark indexes were in negative territory.

Could Apple be trying to signal upside reversal before the indexes?

I doubt it.

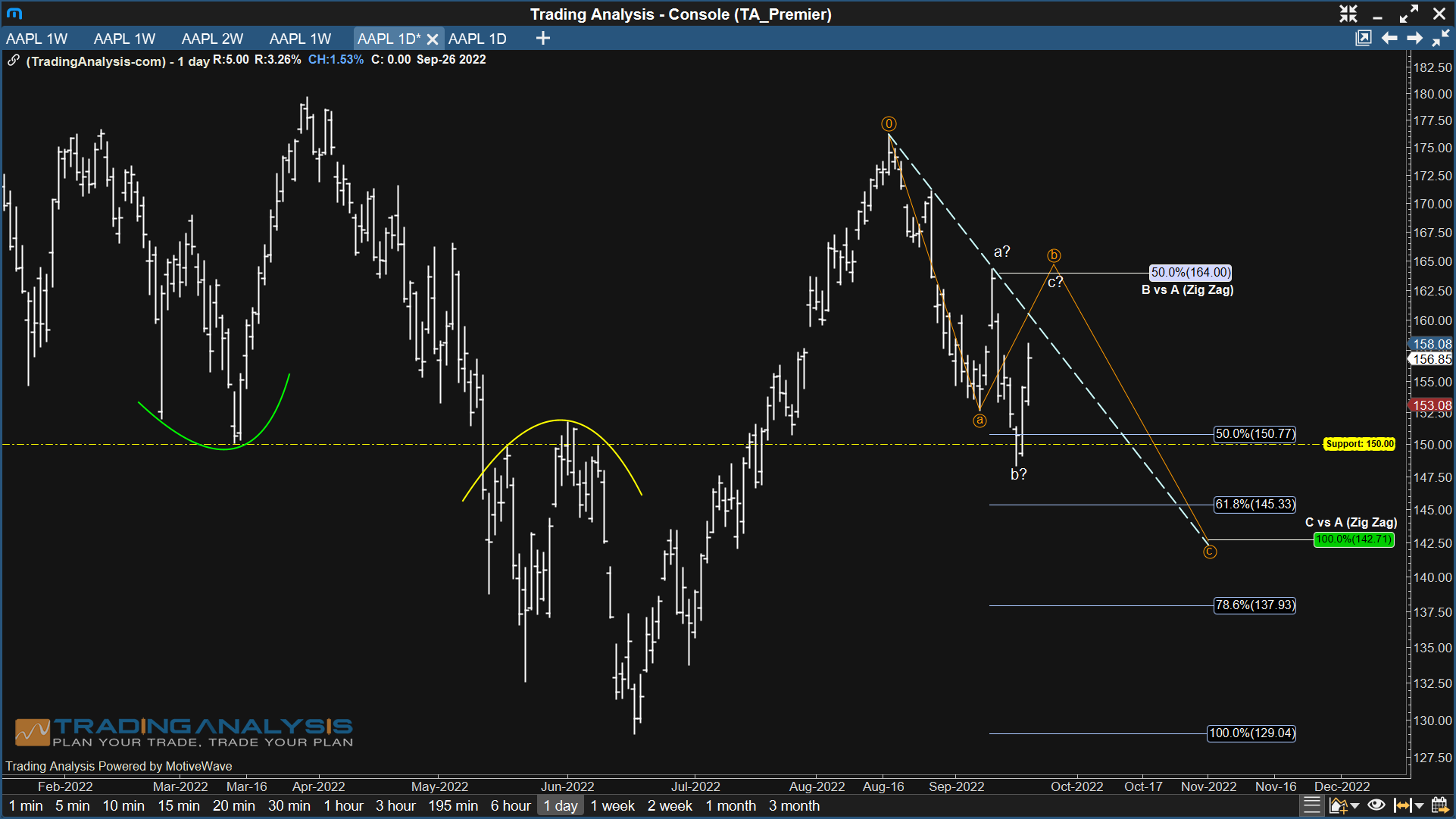

To me, this looks like a technical retracement to confirm resistance, after one final attempt at holding $150 area support.

So although I doubt the correction is over, the question now becomes:

… Do we rally all the way back to $164 resistance BEFORE we break downside support?

And if that is the case, should we be considering that possibility in the market indexes?

I think so.

In fact, it would fit the old market adage that suggests prices tend to go to the most obvious places in the least obvious ways possible.

How Can The Indexes Rally?

If we are going to consider the idea that Apple rallies all the way back to $164 before turning lower and breaking support, then we must consider a similar possibility in the major indexes.

If that proves to be the case, it would mean the initial ‘leg’ of the downside move ended Sep 6th, and we are still trading in a correction of the decline.

Why is this important?

With market sentiment mixed, it opens up the possibility we rally all the way back to 4,100 before turning lower.

… Which would in turn inflict maximum pain on traders and investors, leaving bears questioning their conviction, while bulls take what I would view to be a premature victory lap.

Or perhaps the correction of the initial decline ended Sep 12th, and we are already inside of the next move lower…

Either way, we’ll be talking about it tomorrow morning on our YouTube livestream, and looking for the best ways to trade around it with clients in our weekly Premier Trader Member Webinar.

If you are interested in joining us, see the links below!

TradingAnalysis.com Premier Trader

Our Flagship Service Premier Trader is a timely and insightful research and alert service that will benefit traders of all skill levels. Run by our team of uniquely experienced traders, we cover everything from the Major Market Indexes, to Individual Stocks and Macro analysis.

Features Include:

–5 Video Updates Per Week

–Weekly Member Webinar

–Intraday Chart & Market Updates

–Stock & Option Swing Trades

Regular Price: $177/Month

14-Day Trial: $47 Today