Markets Turn Lower – Now what?

By Bennett Tindle August 23rd, 2022

Last week I told you markets were gearing up for a selloff, and Friday the indexes turned sharply lower.

So hopefully you weren’t taken by surprise, but instead were prepared for the decline.

Now that it is upon us, I want you to be prepared for what comes next.

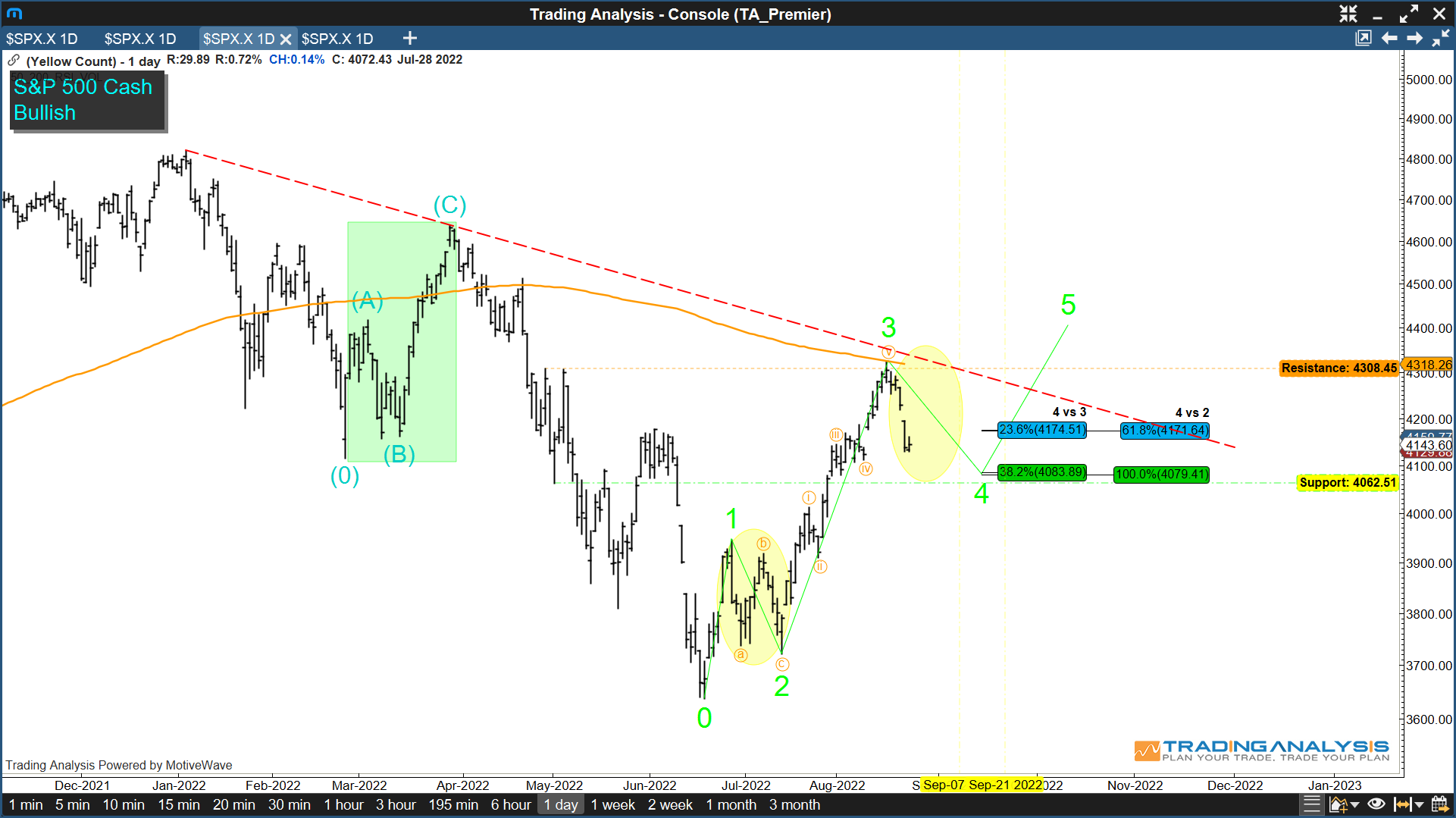

If we are right in suggesting the June 17th low as the end of the 2022 correction, then markets should consolidate back down towards 4050 – 4100 to confirm support.

If alternatively this HAS been a “corrective”, or ‘bear market’ rally similar to the Feb 24 – Mar 30 uptrend, then watch the current pullback for signs of downside acceleration.

If downside acceleration occurs, a move under 3945.86 in the S&P 500 will invalidate the uptrend and confirm a move to new lows in the indexes.

For now we continue to look sideways to lower into September, with all eyes on 4050 – 4100 S&P support for signs of life.

Tune in to our Public Market Update video below for more information, or join us live tomorrow morning on YouTube!

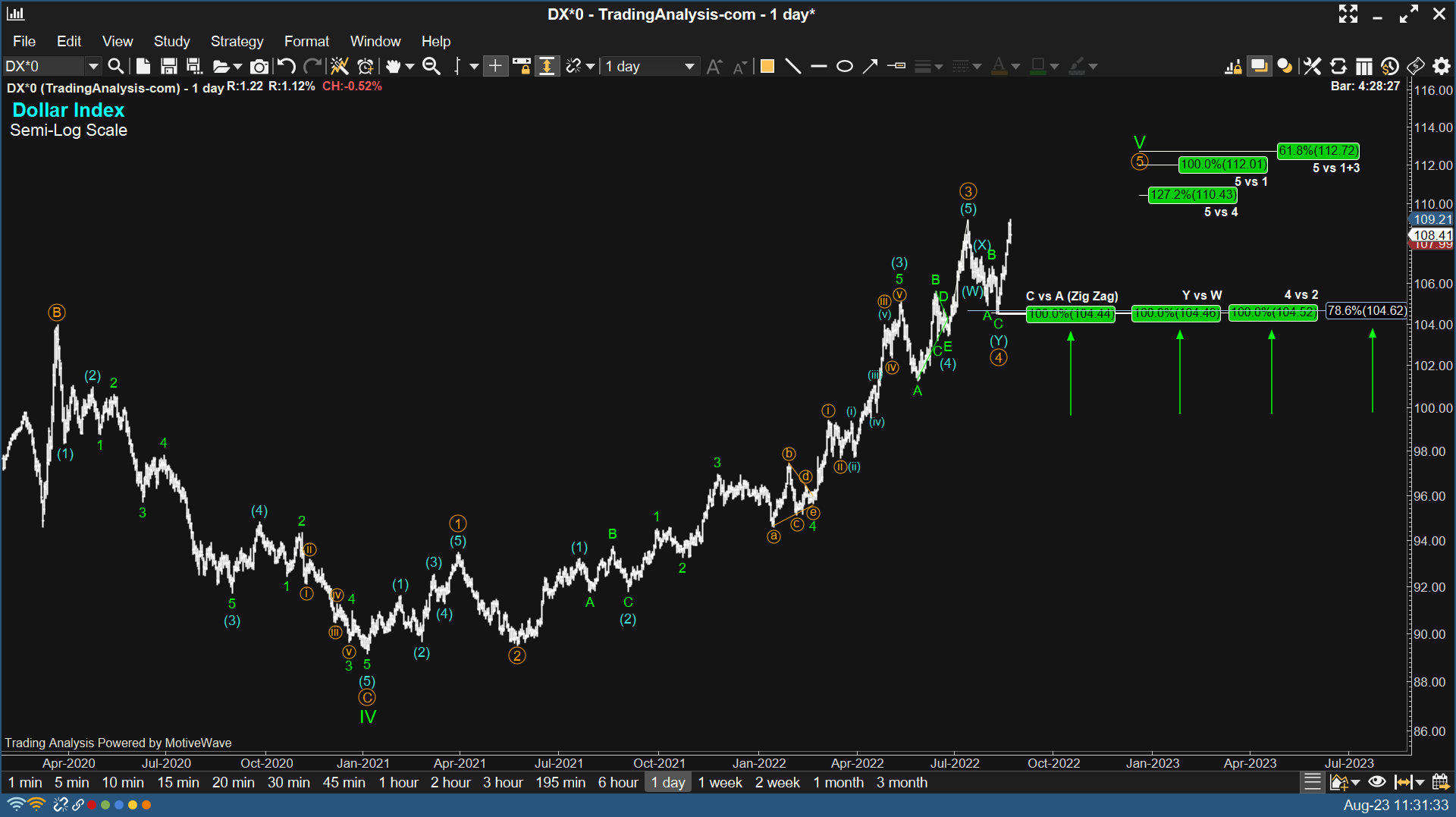

The Dollar Index Rally

One key development we continue to monitor that could influence markets moving forward is the continued upside in the US Dollar Index.

Although the trend may be nearing completion, it’s possible we have further upside based on how the chart responded to support last week.

Above are the two ways in which we can keep the dollar uptrend alive, which would continue to put pressure on equity markets.

Public Market Update for 8-23-2022

Join me as I take you through the index, showing you exactly where I expect markets to go next. If the indexes do confirm the uptrend from June, we see opportunity on the horizon.

And if alternatively this has been a corrective rally, I’ll show you exactly where that would be confirmed, and what the downside targets would be!

dear sir also look into nifty 50 charts once please