This is an exclusive, members-only webinar that takes a deep dive into our current positions, potential trade setups, our trading methodologies, and have all of your questions and comments addressed!

Member’s Video for Thursday, February 22nd, 2018

2/22/18 – 11:10 AM EST Update –

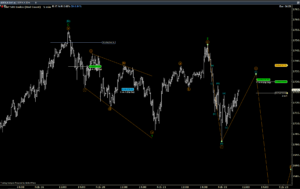

Hi Traders – the Chart Room is updated: CLICK HERE I’m just watching this weak bounce this morning following Fed minutes yesterday. It looks corrective in nature and I remain bearish for now. Sectors leading today are real estate, energy, utilities, industrials, materials, and staples; not exactly the stuff bull markets are made of. However, know we are not married to bearish case and with a bit more bullish price action I have a shopping list of longs prepped. TSLA is one of them and we remain long AMZN. If the bearish case is to remain, we must stay below 2738.

Markets cracked following Fed minutes pushing our positions moved into profitability, but it wasn’t immediate. It came after about 20 minutes of thinking about the reality of higher rates. Is the USD working into a longer-term low now while gold is working a top? Either way, the indexes look to have held wave B/2 high and we’re set to move lower in 3/C. Let’s get our short selling shoes out and be ready for the big show tomorrow.

Weekly Member Webinar

Member’s Webinar – Tuesday’s with Todd – Every Tuesday at 10:30 AM New York Time