Member’s Video for Tuesday, October 17th, 2017

Let’s trade the NFLX earnings report live and then dissect this very ominous sign in the NASDAQ 100 daily chart.

Also, we are launching a MotiveWave beta program for a new offering. If you would like to help in the testing, please email me @ todd@tradinganalysis.com. Thanks!

Trades Issued Monday: long NFLX Tier 4 – Earnings Trade BUY +1 BUTTERFLY NFLX 100 20 OCT 17 200/210/220 CALL @1.80 LMT. In the options that expire Friday, sell 2 of the 210 calls, buy 1 of the 200 calls and 1 of the 220 calls for a debit of $1.80 or less.

THE 30-YR STORM IS APPROACHING – ARE YOU PREPARED?

How To Ride The Wave to Safety and Then Prosperity

- A Simple Approach To Identify Elliott Wave Patterns And Reduce Subjectivity

- How To Identify When The Coming Storm Is About To Explode

- Show you how to trade with EQ – Emotional Intelligence and not like a caveman

Todd’s Trading Lifestyle Vlog #33 – For Trading, FORGET What You Learned In College

Open A ThinkorSwim Account- Thinkorswim

All trades are executed through ThinkorSwim. Register using this link and you will receive discounted commissions exclusively through TradingAnalysis.com – CLICK HERE

Create your survey with SurveyMonkey

TG,

Video not working, sounds like you had a triple Woodford Reserve. Check it out.

Thanks for all you do.

PJP

Hahaha – needed that laugh. No Woodford until I launch this Elliott Wave training course. I replayed the video and I don’t hear anything off? Did you try rebooting, maybe a new browser? Can you tell me the tech setup you’re working such the operating system (windows, mac?), how you’re connected to the internet?

Thanks,

Todd.

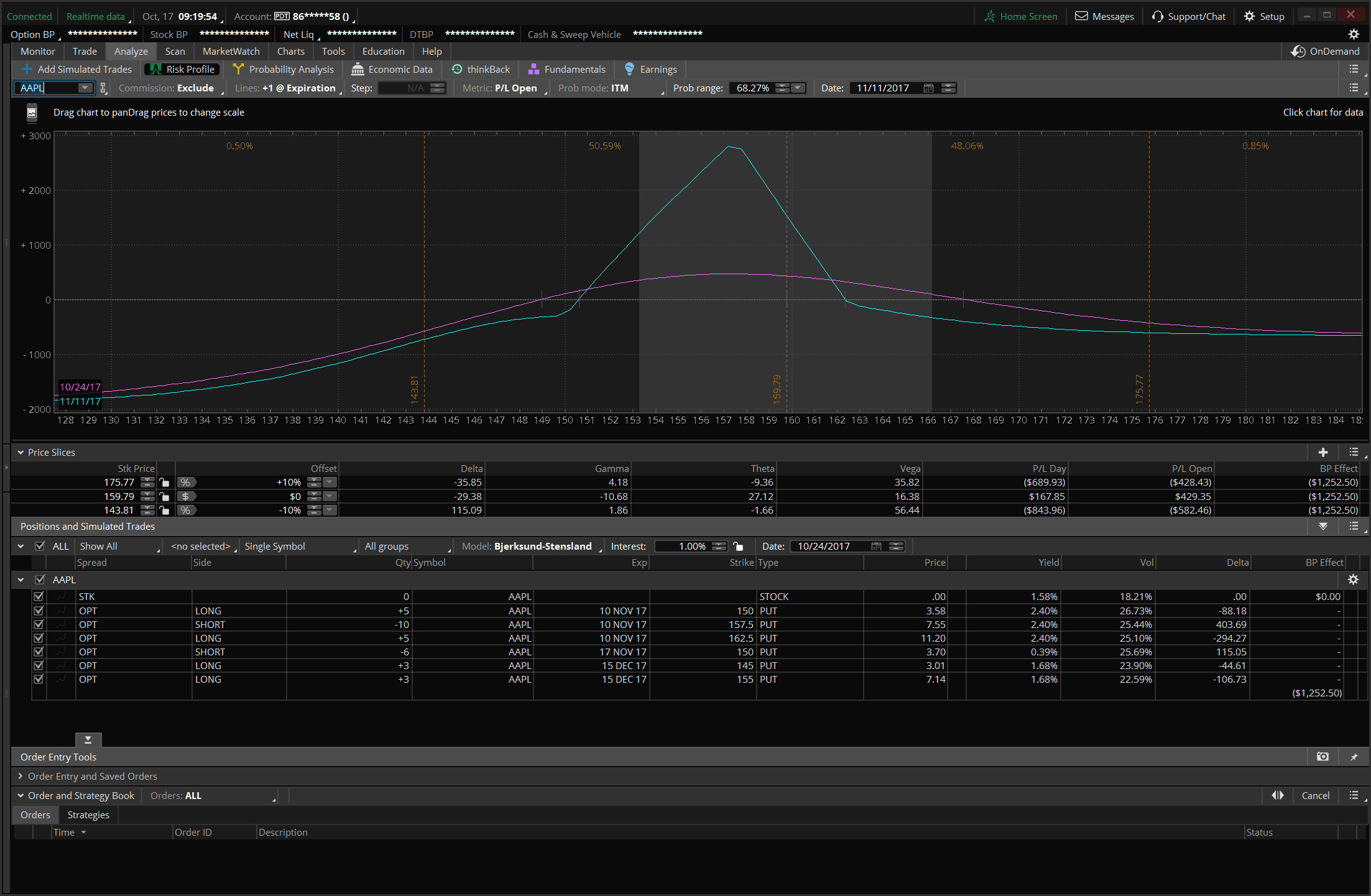

Todd, On the AAPL trades, does it make sense to take off the 155/150/145 Bfly with it trading close to 160? The trade looks to have a better P&L opportunity without it. Thx, Jim S.

Hi James,

Remember, we’re carrying 2 positions in Apple as pictured here. Apple Positions With the combination of the two positions we would like to see Apple back off to around $157 as we trade $159.75. I think the overall market is getting overbought so I would prefer to shade our Apple position with negative delta and max profit to be slightly lower than current. Does that make sense?

With the combination of the two positions we would like to see Apple back off to around $157 as we trade $159.75. I think the overall market is getting overbought so I would prefer to shade our Apple position with negative delta and max profit to be slightly lower than current. Does that make sense?

Todd.

Thanks Todd for taking the time to go through the AAPL trades today. Your evaluation makes sense. Appreciate it.