Bitcoin’s Last Stand

By Aleksandar

September 06, 2018

We at TradingAnalysis rigorously follow the Elliott Wave methodology to identify the prevailing market patterns to then distill into clear cut trading opportunities. At TradingAnalysis we analyze each market at multiple degrees of trend to identify the most opportunistic and risk averse trading opportunities.

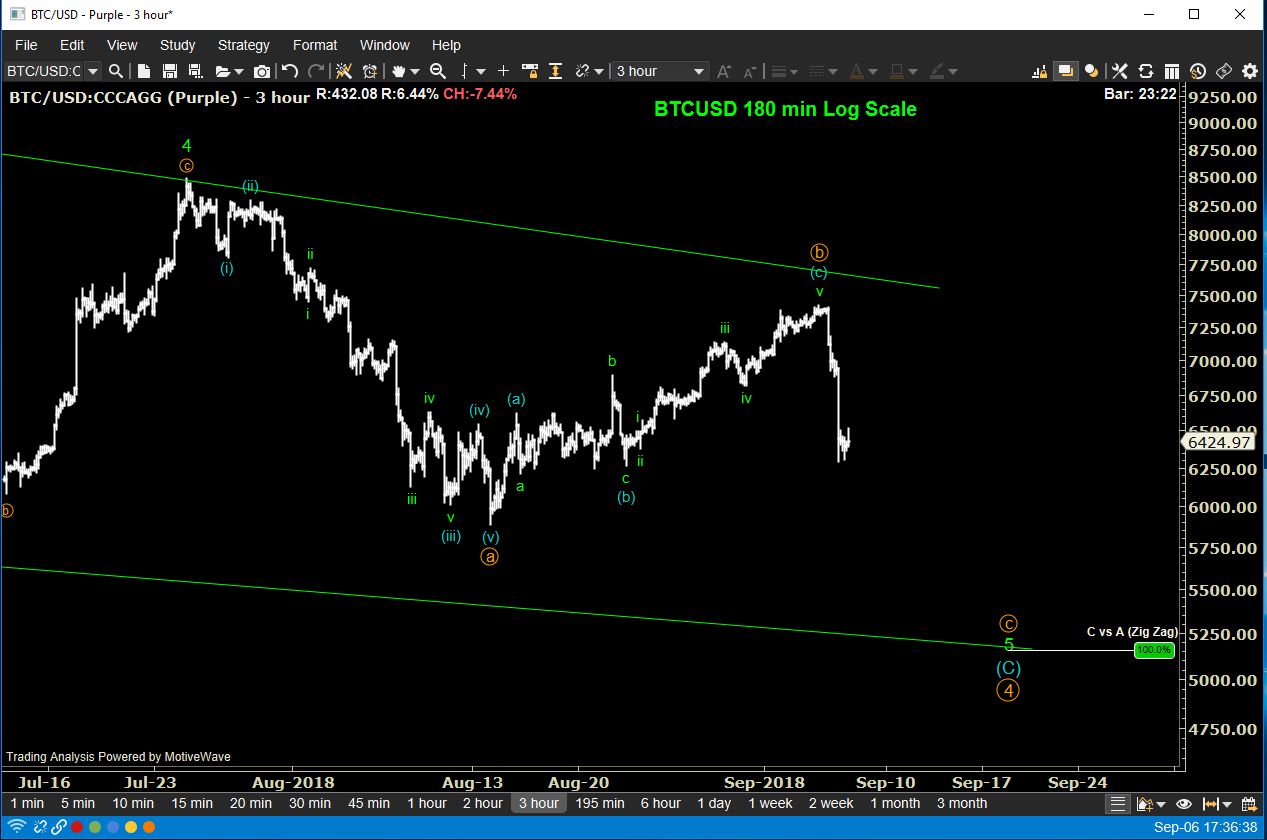

Our most recent example is Bitcoin. On the daily time frame Bitcoin has traced a corrective consolidation from latest highs known as an “A-B-C” pullback (blue (A)-(B)-(C)) with the blue (C)-wave in the final phase of decline targeting the $5,000 area. Specifically, C-wave developed a diagonal pattern which unfolds as a 5-wave trending pattern (green waves 1-5), with each of the 5-waves unfolding in an A-B-C pattern.

To confirm our bearish outlook in Bitcoin other cryptos like ETH are pointing lower, which helps us to stay with our bearish outlook. This increases our chances of Bitcoin reaching $4,800/$5,000 as the potential lows.

Despite the overwhelmingly BULLISH sentiment of the crypto space held by the mainstream media and the crypto believers, the patterns identified through the lens of Elliott Wave suggested the last 2 months were in fact bearish and short positions are preferred. Click here to learn more about our trading style.

Trading Analysis Aleksandar

Blockchain Analyst

Aleksandar has been trading and anlayzing markets with Elliott Wave for over 10 years. He is our lead analyst for the Blockchain crypto service and will also head up our forth-coming Forex service. Aleks works closely with our CEO Todd Gordon on market analysis and trading opportunities. Aleks has worked at an International Treasury and on a institutional trading desk many years. Click Here To Learn More About Aleksandar.

Wow this is my E.W teacher

Good crypto BTC analysis. Forex analysis promisses just promisses, for how long now?

Well done guys, unfortunately I’m a hodler. Won’t be going short but if we are going that much lower than maybe I have to tether a bit here.